Starbucks 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

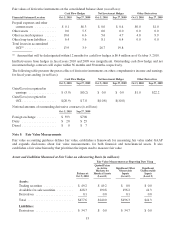

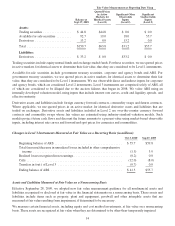

Note 3: Investments (in millions):

Amortized

Cost

Gross

Unrealized

Holding

Gains

Gross

Unrealized

Holding

Losses

Fair

Value

October 3, 2010

Short-term investments:

Available-for-sale securities — Agency obligations .......... $ 30.0 $0.0 $ 0.0 $ 30.0

Available-for-sale securities — Corporate debt securities ...... 15.0 0.0 0.0 15.0

Available-for-sale securities — State and local government

obligations........................................ 0.7 0.0 0.0 0.7

Available-for-sale securities — Government treasury

securities ......................................... 190.7 0.1 0.0 190.8

Trading securities .................................... 58.8 49.2

Total short-term investments .............................. $295.2 $0.1 $285.7

Long-term investments:

Available-for-sale securities — Agency obligations .......... $ 27.0 $0.0 $ 0.0 $ 27.0

Available-for-sale securities — Corporate debt securities ...... 121.4 2.1 0.0 123.5

Available-for-sale securities — State and local government

obligations........................................ 44.8 0.0 (3.5) 41.3

Totallong-terminvestments .............................. $193.2 $2.1 $(3.5) $191.8

September 27, 2009

Short-term investments:

Available-for-sale securities — Corporate debt securities ...... $ 2.5 $0.0 $0.0 $ 2.5

Available-for-sale securities — Government treasury

securities ......................................... 19.0 0.0 0.0 19.0

Trading securities .................................... 58.5 44.8

Total short-term investments .............................. $ 80.0 $ 66.3

Long-term investments:

Available-for-sale securities — State and local government

obligations........................................ $ 57.8 $0.0 $(2.1) $ 55.7

Available-for-sale securities — Corporate debt securities ...... 14.7 0.8 0.0 15.5

Totallong-terminvestments .............................. $ 72.5 $0.8 $(2.1) $ 71.2

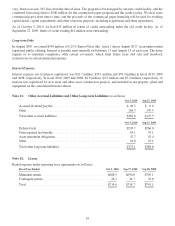

Available-for-sale securities

Proceeds from sales of available-for-sale securities were $1.1 million, $5.0 million and $75.9 million in fiscal years

2010, 2009 and 2008, respectively. For fiscal years 2010, 2009 and 2008, realized gains and losses on sales and

maturities were immaterial.

As of October 3, 2010, long-term available-for-sale securities of $191.8 million included $41.3 million invested in

auction rate securities (“ARS”). As of September 27, 2009, long-term available-for-sale securities of $71.2 million

included $55.7 million invested in ARS. ARS have long-dated maturities but provide liquidity through a Dutch

auction process that resets the applicable interest rate at pre-determined calendar intervals. Due to the auction

failures that began in 2008, these securities became illiquid and were classified as long-term investments. The

investment principal associated with the failed auctions will not be accessible until:

• successful auctions resume;

51