Starbucks 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

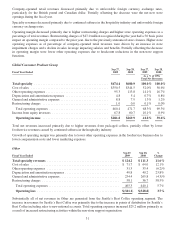

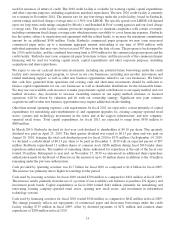

CPG net revenues increased primarily due to the launch of Starbucks VIA®Ready Brew (approximately $22

million) and the extra week in fiscal 2010 (approximately $16 million).

Operating margin decreased 480 basis points over the prior year due primarily to increased Starbucks VIA®Ready

Brew launch expenses.

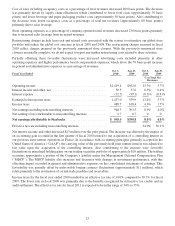

Other

Fiscal Year Ended

Oct 3,

2010

Sep 27,

2009

%

Change

Total specialty revenues ............................................ $ 150.8 $ 124.2 21.4%

Costofsales ...................................................... $ 89.4 $ 71.7 24.7%

Otheroperatingexpenses ............................................ 34.9 31.3 11.5%

Depreciationandamortizationexpenses ................................. 47.4 49.8 (4.8)%

Generalandadministrativeexpenses.................................... 334.1 254.4 31.3%

Restructuringcharges ............................................... 0.0 58.1 (100.0)%

Totaloperatingexpenses........................................... 505.8 465.3 8.7%

Lossfromequityinvestee ............................................ (3.3) 0.0 nm

Operating loss .................................................. $(358.3) $(341.1) 5.0%

Substantially all of net revenues in Other are generated from the Seattle’s Best Coffee operating segment. The

increase in revenues for Seattle’s Best Coffee was primarily due to sales to new national accounts (contributing

approximately $13 million).

Operating expenses included in Other relate to Seattle’s Best Coffee and Digital Ventures as well as expenses

pertaining to corporate administrative functions that support our operating segments but are not specifically

attributable to or managed by any segment and are not included in the reported financial results of the operating

segments. Total operating expenses increased $40.5 million primarily as a result of increased general and

administrative expenses ($80 million) primarily due to higher performance-based compensation in 2010. This

increase was partially offset by a decrease of $58 million in restructuring charges due to the completion of our

restructuring activities within the non-store support organization.

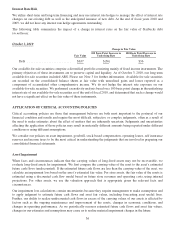

RESULTS OF OPERATIONS — FISCAL 2009 COMPARED TO FISCAL 2008

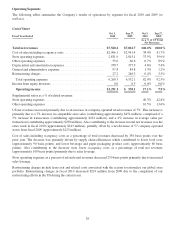

Consolidated results of operations (in millions):

Fiscal Year Ended

Sep 27,

2009

Sep 28,

2008

%

Change

Sep 27,

2009

Sep 28,

2008

%ofTotalNet

Revenues

Net revenues:

Company-operatedretail ....................... $8,180.1 $ 8,771.9 (6.7)% 83.7% 84.5%

Specialty:

Licensing ................................. 1,222.3 1,171.6 4.3% 12.5% 11.3%

Foodserviceandother ....................... 372.2 439.5 (15.3)% 3.8% 4.2%

Totalspecialty ............................... 1,594.5 1,611.1 (1.0)% 16.3% 15.5%

Total net revenues ............................. $9,774.6 $10,383.0 (5.9)% 100.0% 100.0%

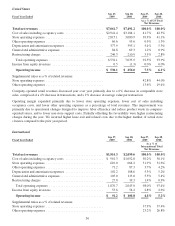

Company-operated retail revenues decreased from fiscal 2008, primarily attributable to a 6% decline in comparable

store sales, comprised of a 4% decline in transactions and a 2% decline in the average value per transaction. Foreign

currency translation also contributed to the decline with the effects of a stronger US dollar relative to the British

pound and Canadian dollar. The weakness in consolidated comparable store sales was driven by the US segment,

with a comparable store sales decline of 6% for the year. The International segment experienced a 2% decline in

comparable store sales.

28