Starbucks 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill Impairment

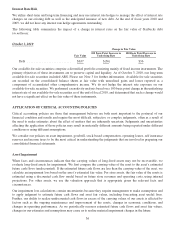

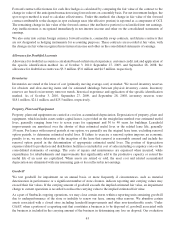

We test goodwill for impairment on an annual basis, or more frequently if circumstances, such as material

deterioration in performance or a significant number of store closures, indicate reporting unit carrying values may

exceed their fair values. If the carrying amount of goodwill exceeds the implied estimated fair value, an impairment

charge to current operations is recorded to reduce the carrying value to the implied estimated fair value. We conduct

our annual goodwill impairment test for consolidated entities in our third fiscal quarter.

Our impairment loss calculations contain uncertainties because they require management to make assumptions and

to apply judgment to estimate the fair value of our reporting units, including estimating future cash flows, and if

necessary, the fair value of a reporting units’ assets and liabilities. Further, our ability to realize the future cash flows

used in our fair value calculations is affected by factors such as changes in economic conditions, changes in our

operating performance, and changes in our business strategies. As we periodically reassess our fair value

calculations, including estimated future cash flows, changes in our estimates and assumptions may cause us to

realize material impairment charges in the future.

As a part of Starbucks ongoing operations, we may close certain stores within a reporting unit containing goodwill

due to underperformance of the store or inability to renew our lease, among other reasons. We abandon certain

assets associated with a closed store including leasehold improvements and other non-transferrable assets. Under

GAAP, when a portion of a reporting unit that constitutes a business is to be disposed of, goodwill associated with

the business is included in the carrying amount of the business in determining any loss on disposal. Our evaluation

of whether the portion of a reporting unit being disposed of constitutes a business occurs on the date of

abandonment. Although an operating store meets the accounting definition of a business prior to abandonment, it

does not constitute a business on the closure date because the remaining assets on that date do not constitute an

integrated set of assets that are capable of being conducted and managed for the purpose of providing a return to

investors. As a result, when closing individual stores, we do not include goodwill in the calculation of any loss on

disposal of the related assets. As noted above, if store closures are indicative of potential impairment of goodwill at

the reporting unit level, we perform an evaluation of our reporting unit goodwill when such closures occur.

Stock-based Compensation

We measure the fair value of stock awards at the grant date based on the fair value of the award and recognize the

expense over the related service period. For stock option awards we use the Black-Scholes-Merton option pricing

model which requires the input of subjective assumptions. These assumptions include estimating the length of time

employees will retain their stock options before exercising them (“expected term”), the estimated volatility of our

common stock price over the expected term and the expected dividend yield. In addition, we are required to estimate

the expected forfeiture rate and only recognize expense for those stock awards expected to vest. We estimate the

forfeiture rate based on historical experience. Changes in our assumptions could materially affect the estimate of fair

value of stock-based compensation; however, a 10% change in our critical assumptions including volatility and

expected term would not have a material impact for fiscal year 2010.

Operating Leases

We lease retail stores, roasting and distribution facilities and office space under operating leases. We provide for an

estimate of asset retirement obligation (“ARO”) expense at the lease inception date for operating leases with

requirements to remove leasehold improvements at the end of the lease term. Estimating AROs involves subjective

assumptions regarding both the amount and timing of actual future retirement costs. Future actual costs could differ

significantly from amounts initially estimated. In addition, the large number of operating leases and the significant

number of international markets in which we have operating leases adds administrative complexity to the calculation

of ARO expense, as well as to the other technical accounting requirements of operating leases such as contingent

rent. Estimating the cost of certain lease exit costs involves subjective assumptions, including the time it would take

to sublease the leased location and the related potential sublease income. The estimated accruals for these costs

could be significantly affected if future experience differs from that used in the initial estimate.

37