Starbucks 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

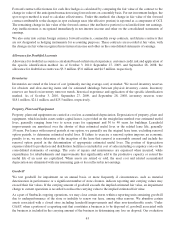

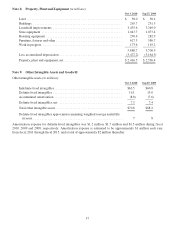

During fiscal 2010, we recognized fair market value adjustments with a charge to earnings to assets measured at fair

value (Level 3) on a non-recurring basis, as follows:

Carrying

Value before

adjustment

Fair value

adjustment

Carrying

value after

adjustment

Property, plant and equipment(1) ........................ $26.8 $(22.3) $4.5

(1) The fair value was determined using a discounted cash flow model based on future store revenues and operating

costs, using internal projections. The resulting impairment charge was included in store operating expenses.

Fair Value of Other Financial Instruments

The carrying value of cash and cash equivalents approximates fair value because of the short-term nature of those

instruments. The estimated fair value of the $550 million of 6.25% Senior Notes based on the quoted market price

was approximately $637 million and $591 million as of October 3, 2010 and September 27, 2009, respectively.

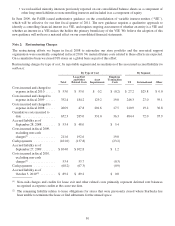

Note 6: Inventories (in millions)

Oct 3, 2010 Sep 27, 2009

Coffee:

Unroasted .................................................... $238.3 $381.6

Roasted ..................................................... 95.1 76.7

Othermerchandiseheldforsale ..................................... 115.6 116.0

Packagingandothersupplies ....................................... 94.3 90.6

Total.......................................................... $543.3 $664.9

Other merchandise held for sale includes, among other items, serveware and tea.

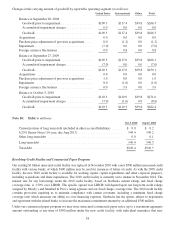

Levels of inventory vary due to seasonality driven primarily by the holiday season, commodity market supply and

price variations, and changes in our use of fixed-price and price-to-be-fixed coffee contracts.

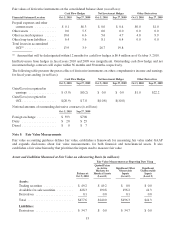

As of October 3, 2010, we had committed to purchasing green coffee totaling $156 million under fixed-price

contracts and an estimated $401 million under price-to-be-fixed contracts. Price-to-be-fixed contracts are purchase

commitments whereby the quality, quantity, delivery period, and other negotiated terms are agreed upon, but the

date at which the base “C” coffee commodity price component will be fixed has not yet been established. For these

types of contracts, either Starbucks or the seller has the option to “fix” the base “C” coffee commodity price prior to

the delivery date. Until prices are fixed, we estimate the total cost of these purchase commitments. We believe,

based on relationships established with our suppliers in the past, the risk of non-delivery on such purchase

commitments is remote.

Note 7: Equity and Cost Investments (in millions)

Oct 3, 2010 Sep 27, 2009

Equitymethodinvestments ........................................ $308.1 $313.2

Costmethodinvestments .......................................... 33.4 39.1

Total.......................................................... $341.5 $352.3

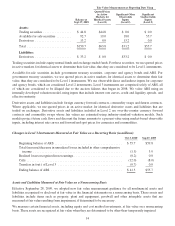

Equity Method Investments

As of October 3, 2010, we had a 50 percent ownership interest in each of the following international equity

investees: Starbucks Coffee Korea Co., Ltd.; Starbucks Coffee Austria GmbH; Starbucks Coffee Switzerland AG;

55