Starbucks 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

President Starbucks Coffee Taiwan Ltd.; Shanghai President Coffee Co.; and Berjaya Starbucks Coffee Company

Sdn. Bhd. (Malaysia). In addition, we had a 39.9 percent ownership interest in Starbucks Coffee Japan, Ltd. These

international entities operate licensed Starbucks retail stores. We also have licensed the rights to produce and

distribute Starbucks branded products to The North American Coffee Partnership with the Pepsi-Cola Company. We

have a 50 percent ownership interest in The North America Coffee Partnership which develops and distributes

bottled Frappuccino®beverages, Starbucks DoubleShot®espresso drinks, and Seattle’s Best Coffee®ready-to-drink

espresso beverages.

Our share of income and losses from our equity method investments is included in income from equity investees on

the consolidated statements of earnings. Also included in this line item is our proportionate share of gross margin

resulting from coffee and other product sales to, and royalty and license fee revenues generated from, equity

investees. Revenues generated from these related parties, net of eliminations, were $125.7 million, $125.3 million

and $128.1 million in fiscal years 2010, 2009 and 2008, respectively. Related costs of sales, net of eliminations,

were $65.3 million, $64.9 million and $66.2 million in fiscal years 2010, 2009 and 2008, respectively. As of

October 3, 2010 and September 27, 2009, there were $31.4 million and $37.6 million of accounts receivable from

equity investees, respectively, on our consolidated balance sheets, primarily related to product sales and store license

fees.

As of October 3, 2010, the aggregate market value of our investment in Starbucks Japan was approximately

$286 million, based on its available quoted market price, which exceeds its carrying value of $154 million.

Summarized combined financial information of our equity method investees, which represent 100% of the

investees’ financial information (in millions):

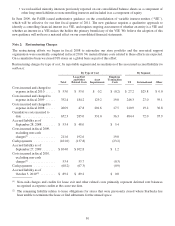

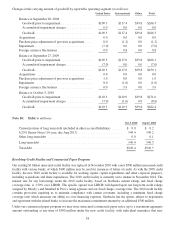

Financial Position as of Oct 3, 2010 Sep 27, 2009

Current assets ................................................. $390.1 $315.8

Noncurrent assets .............................................. 570.3 657.6

Current liabilities .............................................. 260.6 292.0

Noncurrent liabilities ........................................... 70.5 76.5

Results of Operations for Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Netrevenues ........................................ $2,128.0 $2,100.1 $1,961.0

Operatingincome .................................... 245.3 192.5 171.3

Netearnings ........................................ 205.1 155.8 136.9

Cost Method Investments

As of October 3, 2010, we had a $33.4 million investment of equity interests in entities that develop and operate

Starbucks licensed retail stores in several global markets. As of October 3, 2010 and September 27, 2009,

management determined that the estimated fair values of each cost method investment exceeded the related carrying

values. There were no significant impairments recorded during fiscal years 2010, 2009 or 2008.

We have the ability to acquire additional interests in some of these cost method investees at certain intervals.

Depending on our total percentage of ownership interest and our ability to exercise significant influence over

financial and operating policies, additional investments may require the retroactive application of the equity method

of accounting.

56