Starbucks 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

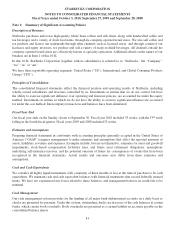

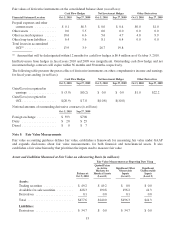

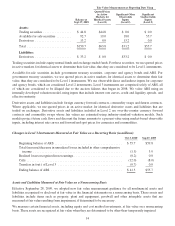

Fair values of derivative instruments on the consolidated balance sheet (in millions):

Cash Flow Hedges Net Investment Hedges Other Derivatives

Financial Statement Location Oct 3, 2010 Sep 27, 2009 Oct 3, 2010 Sep 27, 2009 Oct 3, 2010 Sep 27, 2009

Prepaid expenses and other

current assets ............. $ 0.1 $6.3 $ 0.0 $ 0.4 $0.0 $1.0

Other assets ................ 0.0 5.5 0.0 0.0 0.0 0.0

Other accrued expenses ....... 10.6 6.6 5.6 4.7 4.0 9.9

Other long-term liabilities ...... 6.4 5.6 8.1 6.4 0.0 0.0

Total losses in accumulated

OCI(1) ................... 13.9 3.9 26.7 19.8

(1) Amount that will be dedesignated within 12 months for cash flow hedges is $6.4 million as of October 3, 2010.

Ineffectiveness from hedges in fiscal years 2010 and 2009 was insignificant. Outstanding cash flow hedge and net

investment hedge contracts will expire within 36 months and 30 months, respectively.

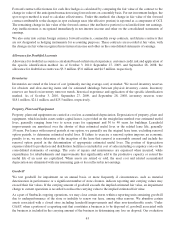

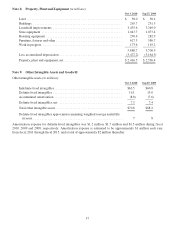

The following table presents the pretax effect of derivative instruments on other comprehensive income and earnings

for fiscal years ending (in millions):

Cash Flow Hedges Net Investment Hedges Other Derivatives

Oct 3, 2010 Sep 27, 2009 Oct 3, 2010 Sep 27, 2009 Oct 3, 2010 Sep 27, 2009

Gain/(Loss) recognized in

earnings ................. $ (5.9) $(0.2) $ 0.0 $ 0.0 $1.0 $22.2

Gain/(Loss) recognized in

OCI..................... $(20.9) $ 7.8 $(10.8) $(10.8)

Notional amounts of outstanding derivative contracts (in millions):

Oct 3, 2010 Sep 27, 2009

Foreignexchange ............ $ 593 $708

Dairy ..................... $ 20 $ 25

Diesel ..................... $ 0 $ 7

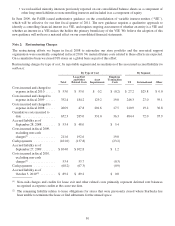

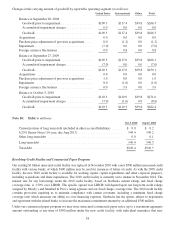

Note 5: Fair Value Measurements

Fair value accounting guidance defines fair value, establishes a framework for measuring fair value under GAAP

and expands disclosures about fair value measurements, for both financial and non-financial assets. It also

establishes a fair value hierarchy that prioritizes the inputs used to measure fair value.

Assets and Liabilities Measured at Fair Value on a Recurring Basis (in millions):

Fair Value Measurements at Reporting Date Using

Balance at

Oct 3, 2010

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Trading securities .................. $ 49.2 $ 49.2 $ 0.0 $ 0.0

Available-for-sale securities .......... 428.3 190.8 196.2 41.3

Derivatives ....................... 0.1 0.0 0.1 0.0

Total ............................ $477.6 $240.0 $196.3 $41.3

Liabilities:

Derivatives ....................... $ 34.7 $ 0.0 $ 34.7 $ 0.0

53