Starbucks 2010 Annual Report Download - page 19

Download and view the complete annual report

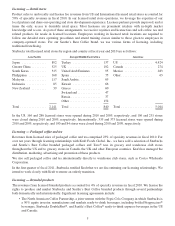

Please find page 19 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our International operations are also subject to additional inherent risks of conducting business abroad, such as:

• foreign currency exchange rate fluctuations;

• changes or uncertainties in economic, legal, regulatory, social and political conditions in our markets;

• interpretation and application of laws and regulations;

• restrictive actions of foreign or US governmental authorities affecting trade and foreign investment,

including protective measures such as export and customs duties and tariffs, government intervention

favoring local competitors, and restrictions on the level of foreign ownership;

• import or other business licensing requirements;

• the enforceability of intellectual property and contract rights;

• limitations on the repatriation of funds and foreign currency exchange restrictions;

• in developing economies, the growth rate in the portion of the population achieving targeted levels of

disposable income may not be as fast as we forecast;

• difficulty in staffing, developing and managing foreign operations and supply chain logistics, including

ensuring the consistency of product quality and service, due to distance, language and cultural differences;

• local laws that make it more expensive and complex to negotiate with, retain or terminate employees; and

• delays in store openings for reasons beyond our control, or a lack of desirable real estate locations available

for lease at reasonable rates, either of which could keep us from meeting annual store opening targets and, in

turn, negatively impact net revenues, operating income and earnings per share.

Moreover, many of the foregoing risks are particularly acute in developing countries, which are important to our

long-term growth prospects.

•Increases in the cost of high-quality arabica coffee beans or other commodities or decreases in the availability

of high quality arabica coffee beans or other commodities could have an adverse impact on our business and

financial results.

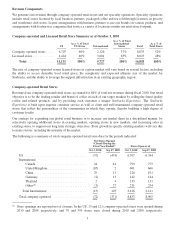

We purchase, roast, and sell high-quality whole bean arabica coffee beans and related coffee products. The price of

coffee is subject to significant volatility and, in fiscal 2010, the base “C” coffee commodity price increased

markedly. The high-quality arabica coffee of the quality we seek tends to trade on a negotiated basis at a substantial

premium above the “C” price. This premium depends upon the supply and demand at the time of purchase and the

amount of the premium can vary significantly. Increases in the “C” coffee commodity price do increase the price of

high-quality arabica coffee and also impact our ability to enter into fixed-price purchase commitments. The supply

and price of coffee we purchase can also be affected by multiple factors in the producing countries, including

weather, political and economic conditions, as well as the actions of certain organizations and associations that have

historically attempted to influence prices of green coffee through agreements establishing export quotas or by

restricting coffee supplies. Speculative trading in coffee commodities can also influence coffee prices. Because of

the significance of coffee beans to our operations, combined with our ability to only partially mitigate future price

risk through purchasing practices (see discussion of “Product Supply” in Item 1 above) and hedging activities,

increases in the cost of high-quality arabica coffee beans could have an adverse impact on our profitability. In

addition, if we are not able to purchase sufficient quantities of green coffee due to any of the above factors or to a

worldwide or regional shortage, we may not be able to fulfill the demand for our coffee, which could have an

adverse impact on our profitability.

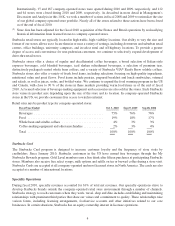

In addition to coffee, we also purchase significant amounts of dairy products, particularly fluid milk, to support the

needs of our company-operated retail stores. Although less material to our operations than coffee or dairy, other

commodities including but not limited to those related to food inputs and energy, are important to our operations.

Increases in the cost of dairy products and other commodities could have an adverse impact on our profitability.

13