Starbucks 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

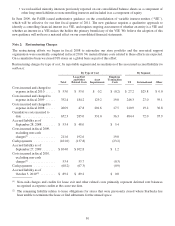

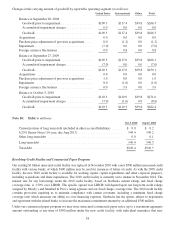

Minimum future rental payments under non-cancelable operating leases as of October 3, 2010 (in millions):

Fiscal Year Ending

2011 ...................................................................... 718.4

2012 ...................................................................... 670.0

2013 ...................................................................... 609.4

2014 ...................................................................... 544.0

2015 ...................................................................... 462.6

Thereafter.................................................................. 1,079.8

Total minimum lease payments ................................................. $4,084.2

We have subleases related to certain of our operating leases. During fiscal 2010, 2009 and 2008, we recognized

sublease income of $10.9 million, $7.1 million and $3.5 million, respectively.

We had capital lease obligations of $2.6 million and $7.8 million as of October 3, 2010 and September 27, 2009,

respectively. Capital lease obligations expire at various dates, with the latest maturity in 2014. The current portion of

the total obligation is included in other accrued expenses and the remaining long-term portion is included in other

long-term liabilities on the consolidated balance sheets. Assets held under capital leases are included in net property,

plant and equipment on the consolidated balance sheets.

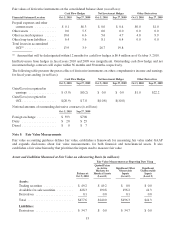

Note 13: Shareholders’ Equity

In addition to 1.2 billion shares of authorized common stock with $0.001 par value per share, we have authorized

7.5 million shares of preferred stock, none of which was outstanding at October 3, 2010.

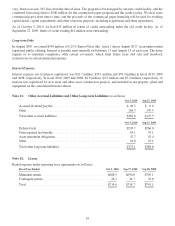

Share repurchase activity during fiscal 2010 (in millions, except for average price data):

Numberofsharesacquired ...................................................... 11.2

Averagepricepershareofacquiredshares .......................................... $ 25.5

Totalcostofacquiredshares ..................................................... $285.6

There were no share repurchases during fiscal 2009. As of October 3, 2010, 10.1 million shares remained available

for repurchase under the current authorization. Subsequent to year end, on November 15, 2010 we announced an

additional share repurchase authorization made by the Board of Directors in the amount of up to 10 million shares in

addition to the 10 million remaining under the previous programs.

During the second quarter of fiscal 2010, the Starbucks Board of Directors approved the initiation of a cash dividend

to shareholders. Quarterly cash dividends of $0.10 and $0.13 per share were paid on April 23, 2010 and August 20,

2010, respectively. During the fourth quarter of fiscal 2010 the Starbucks Board of Directors approved a cash

dividend of $0.13 per share which will be paid on December 3, 2010.

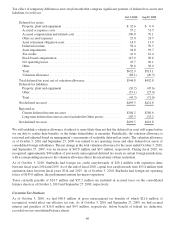

Comprehensive Income

Comprehensive income includes all changes in equity during the period, except those resulting from transactions

with shareholders of the Company. It has two components: net earnings and other comprehensive income.

Accumulated other comprehensive income reported on our consolidated balance sheets consists of foreign currency

translation adjustments and the unrealized gains and losses, net of applicable taxes, on available-for-sale securities

and on derivative instruments designated and qualifying as cash flow and net investment hedges.

60