Starbucks 2010 Annual Report Download - page 49

Download and view the complete annual report

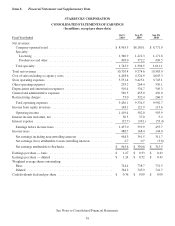

Please find page 49 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARBUCKS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Fiscal Years ended October 3, 2010, September 27, 2009 and September 28, 2008

Note 1: Summary of Significant Accounting Policies

Description of Business

Starbucks purchases and roasts high-quality whole bean coffees and sells them, along with handcrafted coffee and

tea beverages and a variety of fresh food items, through its company-operated retail stores. We also sell coffee and

tea products and license our trademarks through other channels such as licensed stores, and through certain of our

licensees and equity investees, we produce and sell a variety of ready-to-drink beverages. All channels outside the

company-operated retail stores are collectively known as specialty operations. Additional details on the nature of our

business are in Item 1 of this 10-K.

In this 10-K, Starbucks Corporation (together with its subsidiaries) is referred to as “Starbucks,” the “Company,”

“we,” “us” or “our”.

We have three reportable operating segments: United States (“US”), International, and Global Consumer Products

Group (“CPG”).

Principles of Consolidation

The consolidated financial statements reflect the financial position and operating results of Starbucks, including

wholly owned subsidiaries and investees controlled by us. Investments in entities that we do not control, but have

the ability to exercise significant influence over operating and financial policies, are accounted for under the equity

method. Investments in entities in which we do not have the ability to exercise significant influence are accounted

for under the cost method. Intercompany transactions and balances have been eliminated.

Fiscal Year End

Our fiscal year ends on the Sunday closest to September 30. Fiscal year 2010 included 53 weeks, with the 53rd week

falling in the fourth fiscal quarter. Fiscal years 2009 and 2008 included 52 weeks.

Estimates and Assumptions

Preparing financial statements in conformity with accounting principles generally accepted in the United States of

America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of

assets, liabilities, revenues and expenses. Examples include, but are not limited to, estimates for asset and goodwill

impairments, stock-based compensation forfeiture rates, and future asset retirement obligations; assumptions

underlying self-insurance reserves; and the potential outcome of future tax consequences of events that have been

recognized in the financial statements. Actual results and outcomes may differ from these estimates and

assumptions.

Cash and Cash Equivalents

We consider all highly liquid instruments with a maturity of three months or less at the time of purchase to be cash

equivalents. We maintain cash and cash equivalent balances with financial institutions that exceed federally insured

limits. We have not experienced any losses related to these balances, and management believes its credit risk to be

minimal.

Cash Management

Our cash management system provides for the funding of all major bank disbursement accounts on a daily basis as

checks are presented for payment. Under this system, outstanding checks are in excess of the cash balances at certain

banks, which creates book overdrafts. Book overdrafts are presented as a current liability in accounts payable on the

consolidated balance sheets.

43