Starbucks 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

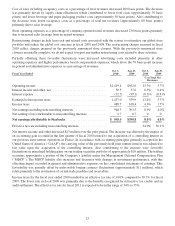

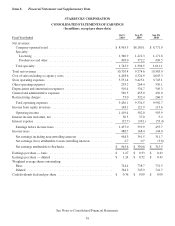

Fiscal Year Ended

Sep 27,

2009

Sep 28,

2008

Sep 27,

2009

Sep 28,

2008

%ofTotalNet

Revenues

Costofsalesincludingoccupancycosts ....................... $4,324.9 $4,645.3 44.2% 44.7%

Storeoperatingexpenses ................................... 3,425.1 3,745.1 35.0% 36.1%

Otheroperatingexpenses................................... 264.4 330.1 2.7% 3.2%

Depreciationandamortizationexpenses ....................... 534.7 549.3 5.5% 5.3%

Generalandadministrativeexpenses .......................... 453.0 456.0 4.6% 4.4%

Restructuringcharges ..................................... 332.4 266.9 3.4% 2.6%

Totaloperatingexpenses ................................. 9,334.5 9,992.7 95.5% 96.2%

Incomefromequityinvestees ............................... 121.9 113.6 1.2% 1.1%

Operating income ..................................... $ 562.0 $ 503.9 5.7% 4.9%

Supplemental ratios as a % of related revenues:

Storeoperatingexpenses ................................... 41.9% 42.7%

Otheroperatingexpenses................................... 16.6% 20.5%

Cost of sales including occupancy costs decreased as a percentage of revenues primarily due to the implementation

of in-store operational efficiencies designed to reduce product waste, and due to lower dairy costs in the US,

partially offset by higher coffee costs.

Store operating expenses as a percentage of company-operated retail revenues decreased primarily due to reduced

headcount and spending in the regional support organization as a result of our restructuring efforts, and the effect of

initiatives to improve store labor efficiencies.

Restructuring charges include lease exit and related costs associated with the actions to rationalize our global store

portfolio and reduce the global cost structure.

Operating margin expansion was primarily due to the improved labor efficiency and reduced product waste in

company-operated stores, partially offset by increased restructuring charges.

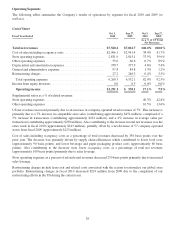

Fiscal Year Ended

Sep 27,

2009

Sep 28,

2008

Sep 27,

2009

Sep 28,

2008

%ofTotalNet

Revenues

Operatingincome ........................................... $562.0 $503.9 5.7% 4.9%

Interestincomeandother,net .................................. 37.0 5.2 0.4% 0.1%

Interestexpense ............................................. (39.1) (53.4) (0.4)% (0.5)%

Earningsbeforeincometaxes .................................. 559.9 455.7 5.7% 4.4%

Incometaxes ............................................... 168.4 144.0 1.7% 1.4%

Net earnings including noncontrolling interests ..................... 391.5 311.7 4.0 3.0

Net earnings (loss) attributable to noncontrolling interests ............ 0.7 (3.8) 0 0

Net earnings attributable to Starbucks ......................... $390.8 $315.5 4.0% 3.0%

Effective tax rate including noncontrolling interests ................. 30.1% 31.6%

Net interest income and other increased due primarily to the impact of foreign currency fluctuations on certain

balance sheet amounts. Also contributing to the increase were lower unrealized market value losses on our trading

securities portfolio compared to fiscal 2008. Interest expense decreased due to a lower average balance of short term

borrowings and lower average short term borrowing rates in fiscal 2009 compared to the prior year. At the end of

fiscal 2009, we had no short term debt.

The relatively low 2009 effective tax rate was primarily due to a tax benefit recognized for retroactive tax credits

and an income tax credit related to the settlement of an employment tax audit in fiscal 2009. As a result of the audit

settlement, approximately $17 million of expense was recorded in store operating expenses, with an offsetting

income tax credit and no impact to net earnings.

29