Starbucks 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

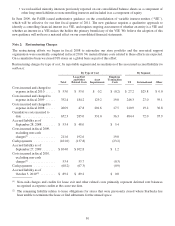

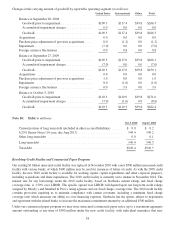

Changes in the carrying amount of goodwill by reportable operating segment (in millions):

United States International Other Total

Balance at September 28, 2008

Goodwill prior to impairment ................... $109.3 $117.4 $39.8 $266.5

Accumulated impairment charges ................ 0.0 0.0 0.0 0.0

Goodwill ................................... $109.3 $117.4 $39.8 $266.5

Acquisitions .................................. 0.0 0.0 0.0 0.0

Purchasepriceadjustmentofpreviousacquisitions .... 0.0 (1.2) 0.0 (1.2)

Impairment ................................... (7.0) 0.0 0.0 (7.0)

Foreigncurrencyfluctuations ..................... 0.0 0.8 0.0 0.8

Balance at September 27, 2009

Goodwill prior to impairment ................... $109.3 $117.0 $39.8 $266.1

Accumulated impairment charges ................ (7.0) 0.0 0.0 (7.0)

Goodwill ................................... $102.3 $117.0 $39.8 $259.1

Acquisitions .................................. 0.0 0.0 0.0 0.0

Purchasepriceadjustmentofpreviousacquisitions .... 1.0 0.0 0.0 1.0

Impairment ................................... 0.0 (1.6) 0.0 (1.6)

Foreigncurrencyfluctuations ..................... 0.0 3.9 0.0 3.9

Balance at October 3, 2010

Goodwill prior to impairment ................... $110.3 $120.9 $39.8 $271.0

Accumulated impairment charges ................ (7.0) (1.6) 0.0 (8.6)

Goodwill ................................... $103.3 $119.3 $39.8 $262.4

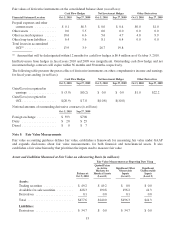

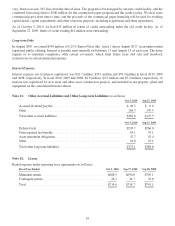

Note 10: Debt (in millions)

Oct 3, 2010 Sep 27, 2009

Current portion of long-term debt (included in other accrued liabilities) ...... $ 0.0 $ 0.2

6.25% Senior Notes (10-year, due Aug 2017) .......................... 549.4 549.2

Otherlong-termdebt ............................................. 0.0 0.1

Long-termdebt.................................................. 549.4 549.3

Totaldebt ...................................................... $549.4 $549.5

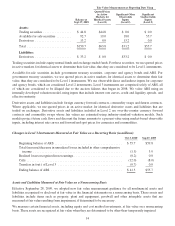

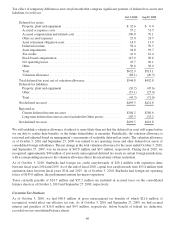

Revolving Credit Facility and Commercial Paper Program

Our existing $1 billion unsecured credit facility was replaced in November 2010 with a new $500 million unsecured credit

facility with various banks, of which $100 million may be used for issuances of letters of credit. As with the 2005 credit

facility, the new 2010 credit facility is available for working capital, capital expenditures and other corporate purposes,

including acquisitions and share repurchases. The 2010 credit facility is currently set to mature in November 2014. The

interest rate for any borrowings under the 2010 credit facility, based on Starbucks current ratings and fixed charge

coverage ratio, is 1.50% over LIBOR. The specific spread over LIBOR will depend upon our long-term credit ratings

assigned by Moody’s and Standard & Poor’s rating agencies and our fixed charge coverage ratio. The 2010 credit facility

contains provisions requiring us to maintain compliance with certain covenants, including a minimum fixed charge

coverage ratio which measures our ability to cover financing expenses. Starbucks has the option, subject to negotiation

and agreement with the related banks, to increase the maximum commitment amount by an additional $500 million.

Under our commercial paper program we may issue unsecured commercial paper notes, up to a maximum aggregate

amount outstanding at any time of $500 million under the new credit facility, with individual maturities that may

58