Starbucks 2010 Annual Report Download - page 54

Download and view the complete annual report

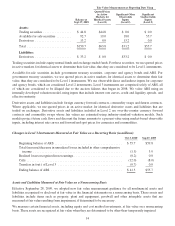

Please find page 54 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising expenses, recorded in store operating expenses, other operating expenses and general and administrative

expenses on the consolidated statements of earnings, totaled $176.2 million, $126.3 million and $129.0 million in

fiscal 2010, 2009 and 2008, respectively. As of October 3, 2010 and September 27, 2009, $5.6 million and

$7.2 million, respectively, of capitalized advertising costs were recorded on the consolidated balance sheets.

Store Preopening Expenses

Costs incurred in connection with the start-up and promotion of new store openings are expensed as incurred.

Operating Leases

We lease retail stores, roasting, distribution and warehouse facilities, and office space under operating leases. Most

lease agreements contain tenant improvement allowances, rent holidays, lease premiums, rent escalation clauses

and/or contingent rent provisions. For purposes of recognizing incentives, premiums and minimum rental expenses

on a straight-line basis over the terms of the leases, we use the date of initial possession to begin amortization, which

is generally when we enter the space and begin to make improvements in preparation of intended use.

For tenant improvement allowances and rent holidays, we record a deferred rent liability in accrued occupancy costs

and other long-term liabilities on the consolidated balance sheets and amortize the deferred rent over the terms of the

leases as reductions to rent expense on the consolidated statements of earnings.

For premiums paid upfront to enter a lease agreement, we record a deferred rent asset in prepaid expenses and other

current assets and other assets on the consolidated balance sheets and then amortize the deferred rent over the terms

of the leases as additional rent expense on the consolidated statements of earnings.

For scheduled rent escalation clauses during the lease terms or for rental payments commencing at a date other than

the date of initial occupancy, we record minimum rental expenses on a straight-line basis over the terms of the leases

on the consolidated statements of earnings.

Certain leases provide for contingent rents, which are determined as a percentage of gross sales in excess of

specified levels. We record a contingent rent liability in accrued occupancy costs on the consolidated balance sheets

and the corresponding rent expense when specified levels have been achieved or when we determine that achieving

the specified levels during the fiscal year is probable.

When ceasing operations in company-operated stores under operating leases, in cases where the lease contract

specifies a termination fee due to the landlord, we record such expense at the time written notice is given to the

landlord. In cases where terms, including termination fees, are yet to be negotiated with the landlord, we will record

the expense upon signing of an agreement with the landlord. In cases where the landlord does not allow us to

prematurely exit the lease, but allows for subleasing, we estimate the fair value of any sublease income that can be

generated from the location and expense the present value of the excess of remaining lease payments to the landlord

over the projected sublease income at the cease-use date.

Asset Retirement Obligations

We recognize a liability for the fair value of required asset retirement obligations (“ARO”) when such obligations

are incurred. Our AROs are primarily associated with leasehold improvements which, at the end of a lease, we are

contractually obligated to remove in order to comply with the lease agreement. At the inception of a lease with such

conditions, we record an ARO liability and a corresponding capital asset in an amount equal to the estimated fair

value of the obligation. The liability is estimated based on a number of assumptions requiring management’s

judgment, including store closing costs, cost inflation rates and discount rates, and is accreted to its projected future

value over time. The capitalized asset is depreciated using the convention for depreciation of leasehold improvement

assets. Upon satisfaction of the ARO conditions, any difference between the recorded ARO liability and the actual

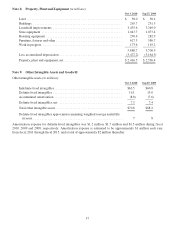

retirement costs incurred is recognized as an operating gain or loss in the consolidated statements of earnings. As of

October 3, 2010 and September 27, 2009, our net ARO asset included in property, plant and equipment was

$13.7 million and $15.1 million, respectively, while our net ARO liability included in other long-term liabilities was

$47.7 million and $43.4 million, as of the same respective dates.

48