Starbucks 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

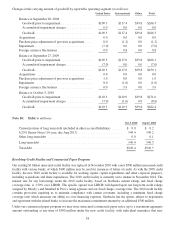

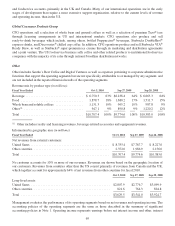

The following table summarizes the activity related to our unrecognized tax benefits (in millions):

Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Beginningbalance .................................... $49.1 $ 52.6 $ 58.3

Increase related to prior year tax positions .................. 35.0 4.2 64.9

Decrease related to prior year tax positions ................. (21.4) (11.6) (37.2)

Increase related to current year tax positions ................ 14.1 8.4 17.0

Decrease related to current year tax positions ............... (8.1) (0.9) (5.4)

Decreases related to settlements with taxing authorities ....... 0.0 (3.0) (11.1)

Decreases related to lapsing of statute of limitations .......... (0.3) (0.6) (33.9)

Endingbalance ...................................... $68.4 $ 49.1 $ 52.6

We are currently under routine audit by various jurisdictions outside the US as well as US state taxing jurisdictions

for fiscal years 2003 through 2009. We are no longer subject to US federal or state examination for years before

fiscal year 2006, with the exception of four states. We are subject to income tax in many jurisdictions outside the

US. We are no longer subject to examination in any material international markets prior to 2003.

There is a reasonable possibility that approximately $9.5 million of the currently remaining unrecognized tax

benefits, each of which is individually insignificant, may be recognized by the end of fiscal 2011 as the result of a

lapse of the statute of limitations.

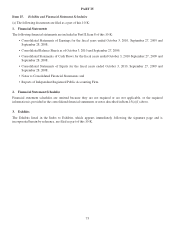

Note 16: Earnings per Share

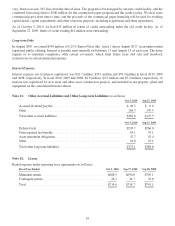

Calculation of net earnings per common share (“EPS”) — basic and diluted (in millions, except EPS):

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Net earnings attributable to Starbucks ..................... $945.6 $390.8 $315.5

Weighted average common shares and common stock units

outstanding(forbasiccalculation).................... 744.4 738.7 731.5

Dilutive effect of outstanding common stock options and

RSUs .......................................... 19.8 7.2 10.2

Weighted average common and common equivalent shares

outstanding(fordilutedcalculation) .................. 764.2 745.9 741.7

EPS—basic ........................................ $ 1.27 $ 0.53 $ 0.43

EPS—diluted....................................... $ 1.24 $ 0.52 $ 0.43

Potential dilutive shares consist of the incremental common shares issuable upon the exercise of outstanding stock

options (both vested and non-vested) and unvested RSUs, using the treasury stock method. Potential dilutive shares

are excluded from the computation of earnings per share if their effect is antidilutive. The number of antidilutive

options totaled 20 million, 17 million and 40 million, in fiscal years 2010, 2009 and 2008, respectively.

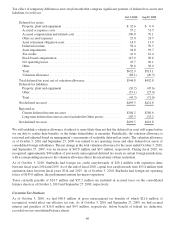

Note 17: Commitments and Contingencies

Guarantees

We have unconditionally guaranteed the repayment of certain Japanese yen-denominated bank loans and related

interest and fees of an unconsolidated equity investee, Starbucks Japan. The guarantees continue until the loans,

including accrued interest and fees, have been paid in full. These guarantees expire in 2014. Our maximum exposure

under this commitment as of October 3, 2010 is $2.6 million and is limited to the sum of unpaid principal and

interest, as well as other related expenses. These amounts will vary based on fluctuations in the yen foreign

exchange rate. Since there has been no modification of these loan guarantees subsequent to the adoption of

accounting requirements for guarantees, we have applied the disclosure provisions only and have not recorded the

guarantees on our consolidated balance sheets.

67