Starbucks 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

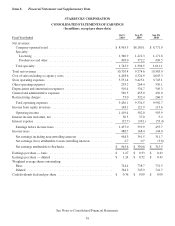

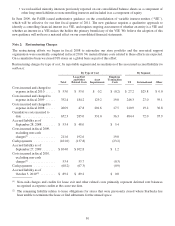

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF EQUITY

(In millions)

Common Stock Additional

Paid-in

Capital

Other

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income/(Loss)

Shareholders’

Equity

Noncontrolling

Interest TotalShares Amount

Balance, September 30, 2007 ....................................... 738.3 $0.7 $ 0.0 $39.4 $2,189.4 $54.6 $2,284.1 $17.3 $2,301.4

Cumulative impact of adoption of accounting requirements for uncertain tax

positions .................................................... 0.0 0.0 (1.6) 0.0 (1.7) 0.0 (3.3) 0.0 (3.3)

Netearnings.................................................... 0.0 0.0 0.0 0.0 315.5 0.0 315.5 (3.8) 311.7

Unrealizedholdinggain,net ....................................... 0.0 0.0 0.0 0.0 0.0 0.8 0.8 0.0 0.8

Translationadjustment,netoftax ................................... 0.0 0.0 0.0 0.0 0.0 (7.0) (7.0) 0.0 (7.0)

Comprehensiveincome ........................................... 309.3 (3.8) 305.5

Stock-basedcompensationexpense.................................. 0.0 0.0 76.8 0.0 0.0 0.0 76.8 0.0 76.8

Exerciseofstockoptions,includingtaxbenefitof$8.4................... 6.6 0.0 77.4 0.0 0.0 0.0 77.4 0.0 77.4

Saleofcommonstock,includingtaxbenefitof$0.1 ..................... 2.8 0.0 41.9 0.0 0.0 0.0 41.9 0.0 41.9

Repurchaseofcommonstock ...................................... (12.2) 0.0 (194.5) 0.0 (100.8) 0.0 (295.3) 0.0 (295.3)

Netcontributionsfromnoncontrollinginterests......................... 0.0 0.0 0.0 0.0 0.0 0.0 0.0 4.8 4.8

Balance, September 28, 2008 ....................................... 735.5 $0.7 $ 0.0 $39.4 $2,402.4 $48.4 $2,490.9 $18.3 $2,509.2

Netearnings.................................................... 0.0 0.0 0.0 0.0 390.8 0.0 390.8 0.7 391.5

Unrealizedholdinggain,net ....................................... 0.0 0.0 0.0 0.0 0.0 1.8 1.8 0.0 1.8

Translationadjustment,netoftax ................................... 0.0 0.0 0.0 0.0 0.0 15.2 15.2 0.0 15.2

Comprehensiveincome ........................................... 407.8 0.7 408.5

Stock-basedcompensationexpense.................................. 0.0 0.0 84.3 0.0 0.0 0.0 84.3 0.0 84.3

Exerciseofstockoptions,includingtaxbenefitof$5.3................... 4.9 0.0 35.9 0.0 0.0 0.0 35.9 0.0 35.9

Saleofcommonstock,includingtaxbenefitof$0.1 ..................... 2.5 0.0 26.8 0.0 0.0 0.0 26.8 0.0 26.8

Net distributions to noncontrolling interests ........................... 0.0 0.0 0.0 0.0 0.0 0.0 0.0 (7.8) (7.8)

Balance, September 27, 2009 ....................................... 742.9 $0.7 $147.0 $39.4 $2,793.2 $65.4 $3,045.7 $11.2 $3,056.9

Netearnings.................................................... 0.0 0.0 0.0 0.0 945.6 0.0 945.6 2.7 948.3

Unrealizedholdingloss,net........................................ 0.0 0.0 0.0 0.0 0.0 (17.0) (17.0) 0.0 (17.0)

Translationadjustment,netoftax ................................... 0.0 0.0 0.0 0.0 0.0 8.8 8.8 0.0 8.8

Comprehensiveincome ........................................... 937.4 2.7 940.1

Stock-basedcompensationexpense.................................. 0.0 0.0 115.6 0.0 0.0 0.0 115.6 0.0 115.6

Exerciseofstockoptions,includingtaxbenefitof$27.7.................. 10.1 0.0 137.5 0.0 0.0 0.0 137.5 0.0 137.5

Saleofcommonstock,includingtaxbenefitof$0.1 ..................... 0.8 0.0 18.5 0.0 0.0 0.0 18.5 0.0 18.5

Repurchaseofcommonstock ...................................... (11.2) 0.0 (285.6) 0.0 0.0 0.0 (285.6) 0.0 (285.6)

Net distributions to noncontrolling interests ........................... 0.0 0.0 0.0 0.0 0.0 0.0 0.0 (0.8) (0.8)

Cashdividend .................................................. 0.0 0.0 0.0 0.0 (267.6) 0.0 (267.6) 0.0 (267.6)

Purchaseofnoncontrollinginterests ................................. 0.0 0.0 (26.8) 0.0 0.0 0.0 (26.8) (5.5) (32.3)

Balance, October 3, 2010 ........................................... 742.6 $0.7 $106.2 $39.4 $3,471.2 $57.2 $3,674.7 $ 7.6 $3,682.3

See Notes to Consolidated Financial Statements.

42