Starbucks 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

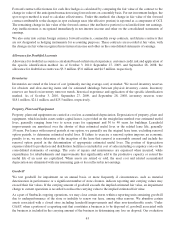

Interest Rate Risk

We utilize short-term and long-term financing and may use interest rate hedges to manage the effect of interest rate

changes on our existing debt as well as the anticipated issuance of new debt. At the end of fiscal years 2010 and

2009, we did not have any interest rate hedge agreements outstanding.

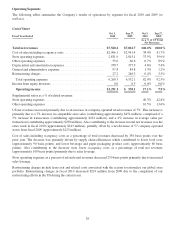

The following table summarizes the impact of a change in interest rates on the fair value of Starbucks debt

(in millions):

October 3, 2010

Change in Fair Value

Fair Value

100 Basis Point Increase in

Underlying Rate

100 Basis Point Decrease in

Underlying Rate

Debt ........................... $637 $(36) $36

Our available-for-sale securities comprise a diversified portfolio consisting mainly of fixed income instruments. The

primary objectives of these investments are to preserve capital and liquidity. As of October 3, 2010, our long-term

available-for-sale securities included ARS. Please see Note 3 for further information. Available-for-sale securities

are recorded on the consolidated balance sheets at fair value with unrealized gains and losses reported as a

component of accumulated other comprehensive income. We do not hedge the interest rate exposure on our

available-for-sale securities. We performed a sensitivity analysis based on a 100 basis point change in the underlying

interest rate of our available-for-sale securities as of the end of fiscal 2010, and determined that such a change would

not have a significant effect on the fair value of these instruments.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

Critical accounting policies are those that management believes are both most important to the portrayal of our

financial condition and results and require the most difficult, subjective or complex judgments, often as a result of

the need to make estimates about the effect of matters that are inherently uncertain. Judgments and uncertainties

affecting the application of those policies may result in materially different amounts being reported under different

conditions or using different assumptions.

We consider our policies on asset impairment, goodwill, stock-based compensation, operating leases, self insurance

reserves and income taxes to be the most critical in understanding the judgments that are involved in preparing our

consolidated financial statements.

Asset Impairment

When facts and circumstances indicate that the carrying values of long-lived assets may not be recoverable, we

evaluate long-lived assets for impairment. We first compare the carrying value of the asset to the asset’s estimated

future cash flows (undiscounted). If the estimated future cash flows are less than the carrying value of the asset, we

calculate an impairment loss based on the asset’s estimated fair value. For store assets, the fair value of the assets is

estimated using a discounted cash flow model based on future store revenues and operating costs, using internal

projections. For other assets, we use the valuation approach that is appropriate given the relevant facts and

circumstances.

Our impairment loss calculations contain uncertainties because they require management to make assumptions and

to apply judgment to estimate future cash flows and asset fair values, including forecasting asset useful lives.

Further, our ability to realize undiscounted cash flows in excess of the carrying values of our assets is affected by

factors such as the ongoing maintenance and improvement of the assets, changes in economic conditions, and

changes in operating performance. As we periodically reassess estimated future cash flows and asset fair values,

changes in our estimates and assumptions may cause us to realize material impairment charges in the future.

36