Starbucks 2010 Annual Report Download - page 44

Download and view the complete annual report

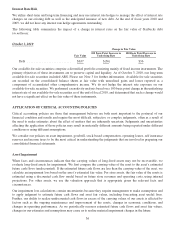

Please find page 44 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Self Insurance Reserves

We use a combination of insurance and self-insurance mechanisms, including a wholly owned captive insurance

entity and participation in a reinsurance treaty, to provide for the potential liabilities for certain risks, including

workers’ compensation, healthcare benefits, general liability, property insurance, and director and officers’ liability

insurance. Liabilities associated with the risks that are retained by Starbucks are not discounted and are estimated, in

part, by considering historical claims experience, demographic factors, severity factors and other actuarial

assumptions. The estimated accruals for these liabilities could be significantly affected if future occurrences and

claims differ from these assumptions and historical trends.

Income Taxes

We recognize deferred tax assets and liabilities based on the differences between the financial statement carrying

amounts and the respective tax bases of our assets and liabilities. Deferred tax assets and liabilities are measured

using current enacted tax rates expected to apply to taxable income in the years in which we expect the temporary

differences to reverse. We routinely evaluate the likelihood of realizing the benefit of our deferred tax assets and

may record a valuation allowance if, based on all available evidence, we determine that some portion of the tax

benefit will not be realized.

In addition, our income tax returns are periodically audited by domestic and foreign tax authorities. These audits

include questions regarding our tax filing positions, including the timing and amount of deductions taken and the

allocation of income among various tax jurisdictions. We evaluate our exposures associated with our various tax

filing positions and record a related liability. We adjust our liability for unrecognized tax benefits and income tax

provision in the period in which an uncertain tax position is effectively settled, the statute of limitations expires for

the relevant taxing authority to examine the tax position, or when more information becomes available.

Deferred tax asset valuation allowances and our liability for unrecognized tax benefits require significant

management judgment regarding applicable statutes and their related interpretation, the status of various income tax

audits, and our particular facts and circumstances. We believe that our estimates are reasonable; however, actual

results could differ from these estimates.

RECENT ACCOUNTING PRONOUNCEMENTS

See Note 1 to the consolidated financial statements in this 10-K.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

The information required by this item is incorporated by reference to the section entitled “Management’s Discussion

and Analysis of Financial Condition and Results of Operations — Commodity Prices, Availability and General Risk

Conditions” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations —

Financial Risk Management” in Item 7 of this Report.

38