Starbucks 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of whether the portion of a reporting unit being disposed of constitutes a business occurs on the date of

abandonment. Although an operating store meets the accounting definition of a business prior to abandonment, it

does not constitute a business on the closure date because the remaining assets on that date do not constitute an

integrated set of assets that are capable of being conducted and managed for the purpose of providing a return to

investors. As a result, when closing individual stores, we do not include goodwill in the calculation of any loss on

disposal of the related assets. As noted above, if store closures are indicative of potential impairment of goodwill at

the reporting unit level, we perform an evaluation of our reporting unit goodwill when such closures occur.

We conduct our annual goodwill impairment test for consolidated entities in our third fiscal quarter.

Other Intangible Assets

Other intangible assets consist primarily of trademarks with indefinite lives which are tested for impairment

annually or more frequently if events or changes in circumstances indicate that the asset might be impaired.

Definite-lived intangible assets, which mainly consist of contract-based patents and copyrights, are amortized over

their estimated useful lives, and are tested for impairment when facts and circumstances indicate that the carrying

values may not be recoverable. Based on the impairment tests performed there was no impairment of other

intangible assets in fiscal 2010, 2009 and 2008.

Long-lived Assets

When facts and circumstances indicate that the carrying values of long-lived assets may not be recoverable, we

evaluate long-lived assets for impairment. We first compare the carrying value of the asset to the asset’s estimated

future cash flows (undiscounted). If the estimated future cash flows are less than the carrying value of the asset, we

calculate an impairment loss based on the asset’s estimated fair value. The fair value of the assets is estimated using

a discounted cash flow model based on future store revenues and operating costs, using internal projections.

Property, plant and equipment assets are grouped at the lowest level for which there are identifiable cash flows when

assessing impairment. Cash flows for retail assets are identified at the individual store level. Long-lived assets to be

disposed of are reported at the lower of their carrying amount, or fair value less estimated costs to sell.

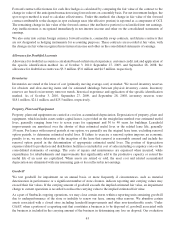

We recognized net impairment and disposition losses of $67.7 million, $224.4 million and $325.0 million in fiscal

2010, 2009 and 2008, respectively, primarily due to underperforming company-operated retail stores. The net losses

in fiscal 2009 and 2008 include $129.2 million and $201.6 million, respectively, of asset impairments related

primarily to the US and International store closures as part of Starbucks store portfolio rationalization which began

in fiscal 2008. Depending on the underlying asset that is impaired, these losses may be recorded in any one of the

operating expense lines on the consolidated statements of earnings: for retail operations, the net impairment and

disposition losses are recorded in restructuring charges and store operating expenses; for specialty operations, these

losses are recorded in restructuring charges and other operating expenses; and for all other operations, these losses

are recorded in cost of sales including occupancy costs, general and administrative expenses, or restructuring

charges.

Insurance Reserves

We use a combination of insurance and self-insurance mechanisms, including a wholly owned captive insurance

entity and participation in a reinsurance treaty, to provide for the potential liabilities for certain risks, including

workers’ compensation, healthcare benefits, general liability, property insurance, and director and officers’ liability

insurance. Liabilities associated with the risks that are retained by us are not discounted and are estimated, in part, by

considering historical claims experience, demographic factors, severity factors and other actuarial assumptions.

Revenue Recognition

Consolidated revenues are presented net of intercompany eliminations for wholly owned subsidiaries and investees

controlled by us and for licensees accounted for under the equity method, based on our percentage ownership.

Additionally, consolidated revenues are recognized net of any discounts, returns, allowances and sales incentives,

including coupon redemptions and rebates.

46