Starbucks 2010 Annual Report Download - page 58

Download and view the complete annual report

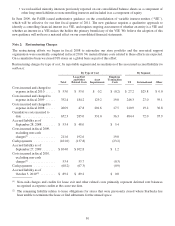

Please find page 58 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• an active secondary market for these securities develops;

• the issuers replace these securities with another form of financing; or

• final payments are made according to the contractual maturities of the debt issues which range from 20 to

35 years.

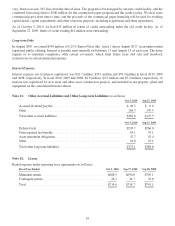

We do not intend to sell the ARS, nor is it likely we will be required to sell the ARS before their anticipated

recovery, which may be at maturity. In fiscal 2010, two ARS were fully called at par value of $6.1 million and three

ARS were partially called at par value of $6.0 million.

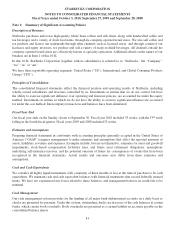

The gross unrealized holding losses on our state and local government obligations as of October 3, 2010 and

September 27, 2009 are all related to our ARS investments. Our ARS are collateralized by portfolios of student

loans, substantially all of which are guaranteed by the United States Department of Education.

Long-term investments (except for ARS) generally mature within three years.

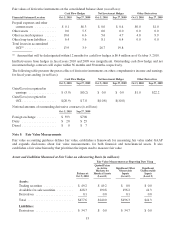

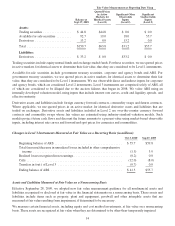

Trading securities

Trading securities are comprised of marketable equity mutual funds and equity exchange-traded funds that

approximate a portion of the liability under the Management Deferred Compensation Plan (“MDCP”), a defined

contribution plan. The corresponding deferred compensation liability of $82.7 million and $68.3 million as of

October 3, 2010 and September 27, 2009, respectively, is included in accrued compensation and related costs on the

consolidated balance sheets. The changes in net unrealized holding gains/losses in the trading portfolio included in

earnings for fiscal years 2010 and 2009 were a net gain of $4.1 million and a net loss of $4.9 million, respectively.

Note 4: Derivative Financial Instruments

Cash Flow Hedges

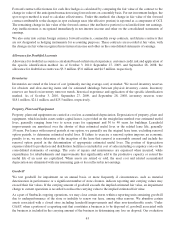

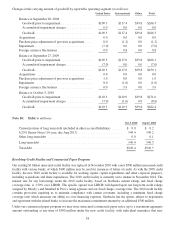

Starbucks and certain subsidiaries enter into cash flow derivative instruments to hedge portions of anticipated

revenue streams and inventory purchases in currencies other than the entity’s functional currency. Outstanding

forward contracts, which comprise the majority of our derivative instruments, hedge monthly forecasted revenue

transactions denominated in Japanese yen and Canadian dollars, as well as forecasted inventory purchases

denominated in US dollars for foreign operations.

Net Investment Hedges

Net investment derivative instruments are used to hedge our equity method investment in Starbucks Coffee Japan,

Ltd. (“Starbucks Japan”) as well as our net investments in our Canada, UK and China subsidiaries, to minimize

foreign currency exposure.

Other Derivatives

To mitigate the translation risk of certain balance sheet items, we enter into certain foreign currency forward

contracts that are not designated as hedging instruments. These contracts are recorded at fair value, with the changes

in fair value recognized in net interest income and other on the consolidated statements of earnings. Gains and losses

from these instruments are largely offset by the financial impact of translating foreign currency denominated

payables and receivables, which are also recognized in net interest income and other.

We also enter into certain swap and futures contracts that are not designated as hedging instruments to mitigate the

price uncertainty of a portion of our future purchases of dairy products and diesel fuel. These contracts are recorded

at fair value, with the changes in fair value recognized in net interest income and other on the consolidated statement

of earnings.

52