Starbucks 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

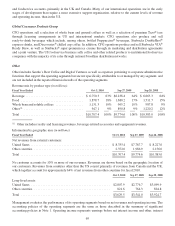

vary, but not exceed, 397 days from the date of issue. The program is backstopped by our new credit facility, and the

combined borrowing limit is $500 million for the commercial paper program and the credit facility. We may issue

commercial paper from time to time, and the proceeds of the commercial paper financing will be used for working

capital needs, capital expenditures and other corporate purposes, including acquisitions and share repurchases.

As of October 3, 2010, we had $15 million in letters of credit outstanding under the old credit facility. As of

September 27, 2009, letters of credit totaling $14 million were outstanding.

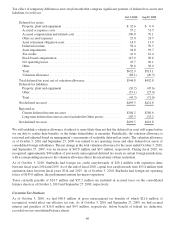

Long-term Debt

In August 2007, we issued $550 million of 6.25% Senior Notes (the “notes”) due in August 2017, in an underwritten

registered public offering. Interest is payable semi-annually on February 15 and August 15 of each year. The notes

require us to maintain compliance with certain covenants, which limit future liens and sale and leaseback

transactions on certain material properties.

Interest Expense

Interest expense, net of interest capitalized, was $32.7 million, $39.1 million and $53.4 million in fiscal 2010, 2009

and 2008, respectively. In fiscal 2010, 2009 and 2008, $4.9 million, $2.9 million and $7.2 million, respectively, of

interest was capitalized for new store and other asset construction projects, and included in net property, plant and

equipment on the consolidated balance sheets.

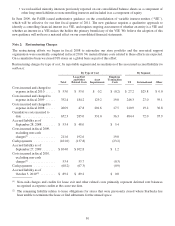

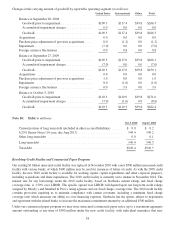

Note 11: Other Accrued Liabilities and Other Long-term Liabilities (in millions)

Oct 3, 2010 Sep 27, 2009

Accrueddividendpayable ......................................... $ 96.5 $ 0.0

Other ......................................................... 166.3 147.5

Total other accrued liabilities ....................................... $262.8 $147.5

Oct 3, 2010 Sep 27, 2009

Deferredrent ................................................... $239.7 $266.0

Unrecognized tax benefits ......................................... 65.1 55.1

Asset retirement obligations ........................................ 47.7 43.4

Other ......................................................... 22.6 25.1

Total other long term liabilities ..................................... $375.1 $389.6

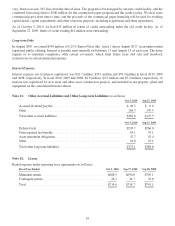

Note 12: Leases

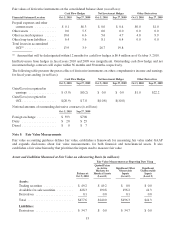

Rental expense under operating lease agreements (in millions):

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Minimumrentals ..................................... $688.5 $690.0 $709.1

Contingentrentals .................................... 26.1 24.7 32.0

Total .............................................. $714.6 $714.7 $741.1

59