Starbucks 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

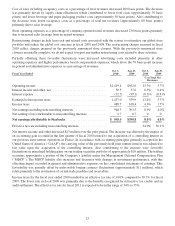

The sensitivity analyses disclosed below provide only a limited, point-in-time view of the market risk of the

financial instruments discussed. The actual impact of the respective underlying rates and price changes on the

financial instruments may differ significantly from those shown in the sensitivity analyses.

Commodity Price Risk

We purchase commodity inputs, including coffee, dairy products and diesel that are used in our operations and are

subject to price fluctuations that impact our financial results. In addition to fixed-price and price-to-be-fixed

contracts for coffee purchases, we have entered into commodity hedges to manage commodity price risk using

financial derivative instruments. We performed a sensitivity analysis based on a 10% change in the underlying

commodity prices of our commodity hedges, as of the end of fiscal 2010, and determined that such a change would

not have a significant effect on the fair value of these instruments.

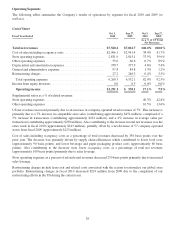

Foreign Currency Exchange Risk

The majority of our revenue, expense and capital purchasing activities are transacted in US dollars. However,

because a portion of our operations consists of activities outside of the US, we have transactions in other currencies,

primarily the Canadian dollar, British pound, euro, and Japanese yen. As a result, we may engage in transactions

involving various derivative instruments to hedge revenues, inventory purchases, assets, and liabilities denominated

in foreign currencies.

As of October 3, 2010, Starbucks had forward foreign exchange contracts that hedge portions of anticipated

international revenue streams and inventory purchases. In addition, we had forward foreign exchange contracts that

qualify as accounting hedges of our net investment in Starbucks Japan to minimize foreign currency exposure.

Starbucks also had forward foreign exchange contracts that are not designated as hedging instruments for accounting

purposes (free standing derivatives), but which largely offset the financial impact of translating certain foreign

currency denominated payables and receivables. Increases or decreases in the fair value of these hedges are

generally offset by corresponding decreases or increases in the US dollar value of our foreign currency denominated

payables and receivables (i.e. “hedged items”) that would occur within the hedging period.

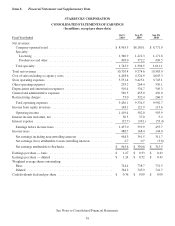

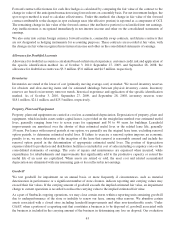

The following table summarizes the potential impact to Starbucks future net earnings and other comprehensive

income (“OCI”) from changes in the fair value of these derivative financial instruments due in turn to a change in

the value of the US dollar as compared to the level of foreign exchange rates. The information provided below

relates only to the hedging instruments and does not represent the corresponding changes in the underlying hedged

items (in millions):

October 3, 2010

Increase/(Decrease) to Net Earnings Increase/(Decrease) to OCI

10% Increase in

Underlying Rate

10% Decrease in

Underlying Rate

10% Increase in

Underlying Rate

10% Decrease in

Underlying Rate

Foreigncurrencyhedges.............. $46 $(46) $13 $(13)

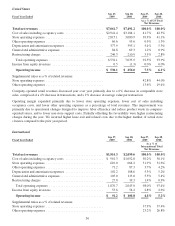

Equity Security Price Risk

We have minimal exposure to price fluctuations on equity mutual funds and equity exchange-traded funds within

our trading portfolio. The trading securities approximate a portion of our liability under the MDCP. A corresponding

liability is included in accrued compensation and related costs on the consolidated balance sheets. These investments

are recorded at fair value with unrealized gains and losses recognized in net interest income and other in the

consolidated statements of earnings. The offsetting changes in the MDCP liability are recorded in general and

administrative expenses. We performed a sensitivity analysis based on a 10% change in the underlying equity prices

of our investments as of the end of fiscal 2010 and determined that such a change would not have a significant effect

on the fair value of these instruments.

35