Starbucks 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

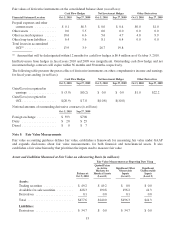

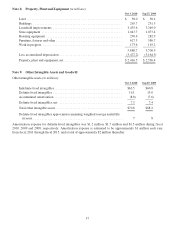

Fair Value Measurements at Reporting Date Using

Balance at

Sept 27, 2009

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Trading securities ................. $ 44.8 $44.8 $ 0.0 $ 0.0

Available-for-sale securities ......... 92.7 19.0 18.0 55.7

Derivatives ...................... 13.2 0.0 13.2 0.0

Total ........................... $150.7 $63.8 $31.2 $55.7

Liabilities:

Derivatives ...................... $ 33.2 $ 0.0 $33.2 $ 0.0

Trading securities include equity mutual funds and exchange-traded funds. For these securities, we use quoted prices

in active markets for identical assets to determine their fair value, thus they are considered to be Level 1 instruments.

Available-for-sale securities include government treasury securities, corporate and agency bonds and ARS. For

government treasury securities, we use quoted prices in active markets for identical assets to determine their fair

value, thus they are considered to be Level 1 instruments. We use observable direct and indirect inputs for corporate

and agency bonds, which are considered Level 2 instruments. Level 3 instruments are comprised solely of ARS, all

of which are considered to be illiquid due to the auction failures that began in 2008. We value ARS using an

internally developed valuation model, using inputs that include interest rate curves, credit and liquidity spreads, and

effective maturity.

Derivative assets and liabilities include foreign currency forward contracts, commodity swaps and futures contracts.

Where applicable, we use quoted prices in an active market for identical derivative assets and liabilities that are

traded on exchanges. Derivative assets and liabilities included in Level 2 are over-the-counter currency forward

contracts and commodity swaps whose fair values are estimated using industry-standard valuation models. Such

models project future cash flows and discount the future amounts to a present value using market-based observable

inputs, including interest rate curves and forward and spot prices for currencies and commodities.

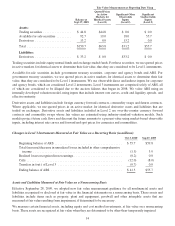

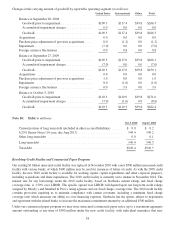

Changes in Level 3 Instruments Measured at Fair Value on a Recurring Basis (in millions):

Oct 3, 2010 Sep 27, 2009

BeginningbalanceofARS ......................................... $55.7 $59.8

Total (increase)/decrease in unrealized losses included in other comprehensive

income ...................................................... (1.5) 3.9

Realized losses recognized in net earnings ............................. (0.2) 0.0

Calls .......................................................... (12.0) (8.0)

Transfersin(out)ofLevel3 ....................................... (0.7) 0.0

EndingbalanceofARS ........................................... $41.3 $55.7

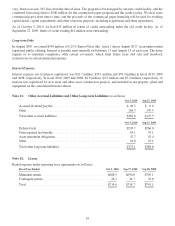

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Effective September 28, 2009, we adopted new fair value measurement guidance for all nonfinancial assets and

liabilities recognized or disclosed at fair value in the financial statements on a nonrecurring basis. These assets and

liabilities include items such as property, plant and equipment, goodwill and other intangible assets that are

measured at fair value resulting from impairment, if determined to be necessary.

We measure certain financial assets, including equity and cost method investments, at fair value on a nonrecurring

basis. These assets are recognized at fair value when they are determined to be other-than-temporarily impaired.

54