Starbucks 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

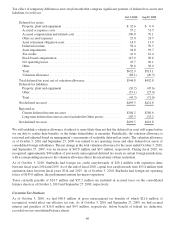

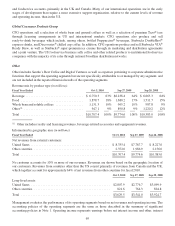

Note 15: Income Taxes

Provision for income taxes (in millions):

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Current taxes:

Federal........................................... $457.5 $165.3 $ 180.4

State ............................................ 79.6 35.0 34.3

Foreign .......................................... 38.3 26.3 40.4

Deferredtaxes,net.................................... (86.7) (58.2) (111.1)

Total .............................................. $488.7 $168.4 $ 144.0

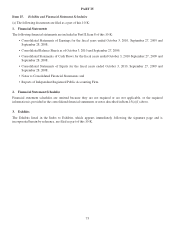

Reconciliation of the statutory US federal income tax rate with our effective income tax rate:

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Statutoryrate ........................................ 35.0% 35.0% 35.0%

Stateincometaxes,netoffederalincometaxbenefit ......... 2.5% 2.6% 2.8%

Foreignearningstaxedatlowerrates...................... -2.5% -2.3% -3.6%

Domestic production activity deduction ................... -0.9% -2.3% -2.6%

Credit resulting from employment audit ................... 0.0% -2.0% 0.0%

Other,net........................................... -0.1% -0.9% -0.3%

Effectivetaxrate ..................................... 34.0% 30.1% 31.3%

US income and foreign withholding taxes have not been provided on approximately $646 million of cumulative

undistributed earnings of foreign subsidiaries and equity investees. We intend to reinvest these earnings for the

foreseeable future. If these amounts were distributed to the US, in the form of dividends or otherwise, we would be

subject to additional US income taxes. Determination of the amount of unrecognized deferred income tax liabilities

on these earnings is not practicable because such liability, if any, is dependent on circumstances existing if and when

remittance occurs.

65