Starbucks 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income from equity investees on the consolidated statements of earnings. The US foodservice business sells coffee

and other related products to institutional foodservice companies with the majority of its sales through national

broadline distribution networks. The CPG segment reflects relatively lower revenues, a modest cost structure, and a

resulting higher operating margin, compared to the other two reporting segments, which consist primarily of retail

stores.

Acquisitions

See Note 18 to the consolidated financial statements in this 10-K.

RESULTS OF OPERATIONS — FISCAL 2010 COMPARED TO FISCAL 2009

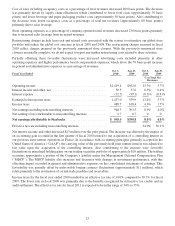

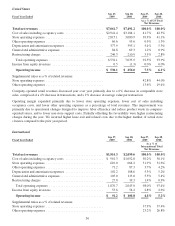

Consolidated results of operations (in millions):

Fiscal Year Ended

Oct 3,

2010

Sep 27,

2009

%

Change

Oct 3,

2010

Sep 27,

2009

%ofTotalNet

Revenues

Net revenues:

Company-operatedretail........................ $ 8,963.5 $8,180.1 9.6% 83.7% 83.7%

Specialty:

Licensing ................................. 1,340.9 1,222.3 9.7% 12.5% 12.5%

Foodserviceandother ........................ 403.0 372.2 8.3% 3.8% 3.8%

Totalspecialty................................ 1,743.9 1,594.5 9.4% 16.3% 16.3%

Total net revenues .............................. $10,707.4 $9,774.6 9.5% 100.0% 100.0%

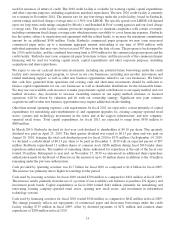

Consolidated net revenues were $10.7 billion for fiscal 2010, an increase of 9.5% over fiscal 2009. The increase was

primarily due to an increase in company-operated retail revenues driven by a 7% increase in global comparable

stores sales (contributing approximately $551 million). The increase in comparable store sales was due to a 4%

increase in number of transactions (contributing approximately $298 million) and a 3% increase in average value per

transaction (contributing approximately $253 million). Also contributing to the increase in revenues was the extra

week in fiscal 2010 (approximately $207 million), foreign currency translation resulting from the weakening of the

US dollar primarily in relation to the Canadian dollar (approximately $101 million), and the effect of consolidating

our previous joint venture in France (approximately $87 million). This increase was partially offset by a net decrease

of 72 company-operated stores from fiscal 2009 (approximately $119 million).

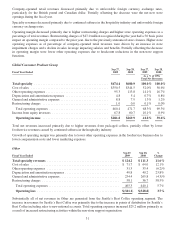

Fiscal Year Ended

Oct 3,

2010

Sep 27,

2009

Oct 3,

2010

Sep 27,

2009

%ofTotalNet

Revenues

Costofsalesincludingoccupancycosts ........................ $4,458.6 $4,324.9 41.6% 44.2%

Storeoperatingexpenses .................................... 3,551.4 3,425.1 33.2% 35.0%

Otheroperatingexpenses ................................... 293.2 264.4 2.7% 2.7%

Depreciationandamortizationexpenses ........................ 510.4 534.7 4.8% 5.5%

Generalandadministrativeexpenses........................... 569.5 453.0 5.3% 4.6%

Restructuringcharges ...................................... 53.0 332.4 0.5% 3.4%

Totaloperatingexpenses .................................. 9,436.1 9,334.5 88.1% 95.5%

Incomefromequityinvestees ................................ 148.1 121.9 1.4% 1.2%

Operating income ...................................... $1,419.4 $ 562.0 13.3% 5.7%

Supplemental ratios as a % of related revenues:

Storeoperatingexpenses .................................... 39.6% 41.9%

Otheroperatingexpenses ................................... 16.8% 16.6%

24