Starbucks 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

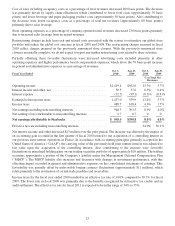

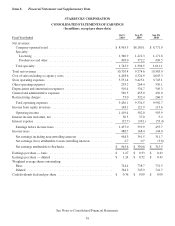

SUMMARIZED QUARTERLY FINANCIAL INFORMATION (unaudited, in millions, except EPS)

First Second Third Fourth Total

2010:

Netrevenues ............................... $2,722.7 $2,534.7 $2,612.0 $2,838.0 $10,707.4

Operating income(1) .......................... 352.6 339.8 327.7 399.3 1,419.4

Net earnings attributable to Starbucks(1) .......... 241.5 217.3 207.9 278.9 945.6

EPS—diluted.............................. 0.32 0.28 0.27 0.37 1.24

2009:

Netrevenues ............................... $2,615.2 $2,333.3 $2,403.9 $2,422.2 $ 9,774.6

Operating income(2) .......................... 117.7 40.9 204.0 199.4 562.0

Net earnings attributable to Starbucks(2) .......... 64.3 25.0 151.5 150.0 390.8

EPS—diluted.............................. 0.09 0.03 0.20 0.20 0.52

(1) Includes pretax restructuring charges of $18.3 million, $7.9 million, $20.4 million and $6.4 million for the first,

second, third and fourth fiscal quarters respectively.

(2) Includes pretax restructuring charges of $75.5 million, $152.1 million, $51.6 million and $53.2 million for the

first, second, third and fourth fiscal quarters respectively.

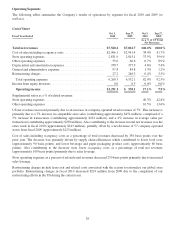

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

Starbucks cash and short-term investments were $1.4 billion and $666 million as of October 3, 2010 and

September 27, 2009, respectively. We actively manage our cash and short-term investments in order to internally

fund operating needs, make scheduled interest and principal payments on our borrowings, and return cash to

shareholders through common stock dividend payments and share repurchases. Our short-term investments

consisted predominantly of US Treasury and US Agency securities.

Our portfolio of long-term available for sale securities consists predominantly of high investment-grade corporate

bonds, diversified among industries and individual issuers. We also have investments in auction rate securities

(“ARS”), nearly all of which are classified as long-term. ARS totaling $41 million and $56 million were outstanding

as of October 3, 2010 and September 27, 2009, respectively. The reduction in ARS was due to $12 million in

redemptions during the fiscal year with all redemptions done at par. While the ongoing auction failures will limit the

liquidity of these ARS investments for some period of time, we do not believe the auction failures will materially

impact our ability to fund our working capital needs, capital expenditures, shareholder dividends or other business

requirements.

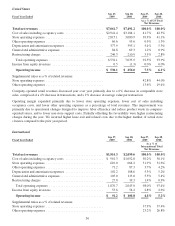

Starbucks $1 billion unsecured credit facility (the “2005 credit facility”) was available for working capital, capital

expenditures, and other corporate purposes. In November of 2010, subsequent to the end of the 2010 fiscal year, we

replaced the 2005 credit facility, which was scheduled to mature in August 2011. The new credit facility is described

in more detail below. The 2005 credit facility was paired with a commercial paper program whereby we could issue

unsecured commercial paper notes, up to a maximum amount outstanding at any time of $1 billion. The commercial

paper program was secured by the credit facility, and the combined borrowing limit was $1 billion for the

commercial paper program and the credit facility. During fiscal 2010 and 2009, there were no borrowings under the

2005 credit facility or commercial paper program. As of October 3, 2010, a total of $15 million in letters of credit

were outstanding under our revolving credit facility.

The 2005 credit facility contained provisions requiring us to maintain compliance with certain covenants, including

a minimum fixed charge coverage ratio. As of October 3, 2010 and September 27, 2009, we were in compliance

with each of these covenants. The $550 million of 10-year 6.25% Senior Notes also require us to maintain

compliance with certain covenants, including limits on future liens and sale and leaseback transactions on certain

material properties. As of October 3, 2010 and September 27, 2009, we were in compliance with each of these

covenants.

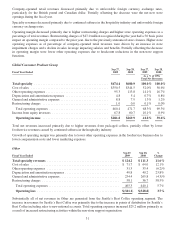

In November of 2010, subsequent to the end of the 2010 fiscal year, we replaced the 2005 credit facility with a

$500 million unsecured credit facility (the “2010 credit facility”) with various banks, of which $100 million may be

32