Starbucks 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of

Equity Securities

SHAREHOLDER INFORMATION

MARKET INFORMATION AND DIVIDEND POLICY

Starbucks common stock is traded on NASDAQ, under the symbol “SBUX.”

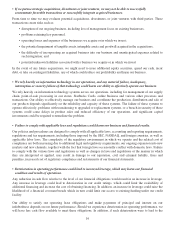

The following table shows the quarterly high and low closing sale prices per share of Starbucks common stock as

reported by NASDAQ for each quarter during the last two fiscal years and the quarterly cash dividend declared per

share of our common stock during the periods indicated:

High Low

Cash Dividends

Declared

2010:

FourthQuarter........................................ $26.39 $22.82 $0.13

ThirdQuarter ........................................ 28.09 24.24 0.13

SecondQuarter ....................................... 25.56 21.70 0.10

FirstQuarter ......................................... 23.74 18.74 0.00

2009:

FourthQuarter........................................ $20.76 $12.97 $0.00

ThirdQuarter ........................................ 15.30 11.11 0.00

SecondQuarter ....................................... 12.39 8.27 0.00

FirstQuarter ......................................... 14.87 7.17 0.00

As of November 12, 2010, we had approximately 21,700 shareholders of record. This does not include persons

whose stock is in nominee or “street name” accounts through brokers.

Future decisions to pay cash dividends continue to be at the discretion of the Board of Directors and will be

dependent on our operating performance, financial condition, capital expenditure requirements, and other such

factors that the Board of Directors considers relevant.

ISSUER PURCHASES OF EQUITY SECURITIES

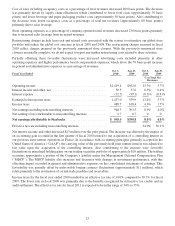

The following table provides information regarding repurchases of our common stock during the 14-week period

ended October 3, 2010:

Total

Number of

Shares

Purchased

Average

Price

Paid per

Share

Total Number

of Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs

Maximum

Number of

Shares that May

Yet Be

Purchased

Under the Plans

or Programs(2)

Period(1)

June 28, 2010 — July 25, 2010 .................. 4,487,620 $24.97 4,487,620 10,095,392

July 26, 2010 — August 22, 2010 ................ 0 0 0 10,095,392

August 23, 2010 — October 3, 2010 .............. 0 0 0 10,095,392

Total ...................................... 4,487,620 $24.97 4,487,620

(1) Monthly information is presented by reference to our fiscal months during the fourth quarter of fiscal 2010.

(2) The share repurchase program is conducted under authorizations made from time to time by the Board of

Directors. The Board of Directors initially authorized the repurchase of 25 million shares of common stock

(publicly announced on May 3, 2007) and later authorized additional repurchases of up to 5 million additional

shares (publicly announced on January 30, 2008) and 15 million shares (publicly announced March 24, 2010).

These authorizations have no expiration date. Subsequent to year end, on November 15, 2010 we announced an

additional share repurchase authorization made by the Board of Directors in the amount of up to 10 million

shares in addition to the 10 million remaining under the previous programs.

18