Starbucks 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and foodservice accounts, primarily in the UK and Canada. Many of our international operations are in the early

stages of development that require a more extensive support organization, relative to the current levels of revenue

and operating income, than in the US.

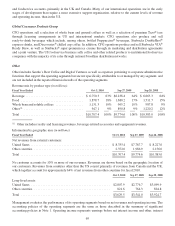

Global Consumer Products Group

CPG operations sell a selection of whole bean and ground coffees as well as a selection of premium Tazo®teas

through licensing arrangements in US and international markets. CPG operations also produce and sell

ready-to-drink beverages which include, among others, bottled Frappuccino®beverages, Starbucks DoubleShot®

espresso drinks, and Discoveries®chilled cup coffee. In addition, CPG operations produce and sell Starbucks VIA®

Ready Brew, as well as Starbucks®super-premium ice creams through its marketing and distribution agreements

and a joint venture. The US foodservice business sells coffee and other related products to institutional foodservice

companies with the majority of its sales through national broadline distribution networks.

Other

Other includes Seattle’s Best Coffee and Digital Ventures as well as expenses pertaining to corporate administrative

functions that support the operating segments but are not specifically attributable to or managed by any segment, and

are not included in the reported financial results of the operating segments.

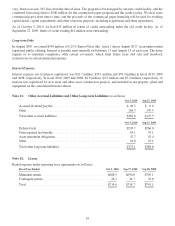

Revenue mix by product type (in millions):

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Beverage ................................... $ 6,750.3 63% $6,238.4 64% $ 6,663.3 64%

Food ...................................... 1,878.7 18% 1,680.2 17% 1,511.7 15%

Wholebeanandsolublecoffees ................. 1,131.3 10% 965.2 10% 987.8 9%

Other(1) .................................... 947.1 9% 890.8 9% 1,220.2 12%

Total ...................................... $10,707.4 100% $9,774.6 100% $10,383.0 100%

(1) Other includes royalty and licensing revenues, beverage-related accessories and equipment revenues.

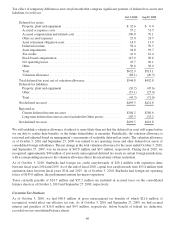

Information by geographic area (in millions):

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Net revenues from external customers:

UnitedStates................................................ $ 8,335.4 $7,787.7 $ 8,227.0

Other countries .............................................. 2,372.0 1,986.9 2,156.0

Total ...................................................... $10,707.4 $9,774.6 $10,383.0

No customer accounts for 10% or more of our revenues. Revenues are shown based on the geographic location of

our customers. Revenues from countries other than the US consist primarily of revenues from Canada and the UK,

which together account for approximately 64% of net revenues from other countries for fiscal 2010.

Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Long-lived assets:

UnitedStates ................................................ $2,807.9 $2,776.7 $3,099.9

Other countries .............................................. 821.6 764.3 824.8

Total ...................................................... $3,629.5 $3,541.0 $3,924.7

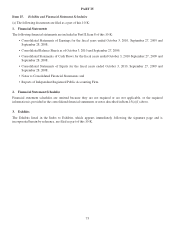

Management evaluates the performance of its operating segments based on net revenues and operating income. The

accounting policies of the operating segments are the same as those described in the summary of significant

accounting policies in Note 1. Operating income represents earnings before net interest income and other, interest

69