Starbucks 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

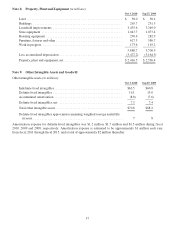

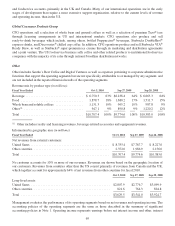

Tax effect of temporary differences and carryforwards that comprise significant portions of deferred tax assets and

liabilities (in millions):

Oct 3, 2010 Sep 27, 2009

Deferred tax assets:

Property,plantandequipment .................................... $ 32.6 $ 0.0

Accruedoccupancycosts ........................................ 55.2 51.5

Accruedcompensationandrelatedcosts ............................ 100.8 70.1

Other accrued expenses ......................................... 25.0 24.5

Asset retirement obligation asset .................................. 14.9 13.9

Deferredrevenue .............................................. 58.4 39.3

Asset impairments ............................................. 94.8 99.7

Taxcredits ................................................... 41.0 61.4

Stock based compensation ....................................... 115.9 96.6

Net operating losses ............................................ 43.7 20.1

Other ....................................................... 50.6 36.0

Total........................................................ $632.9 $513.1

Valuationallowance............................................ (88.1) (20.3)

Total deferred tax asset, net of valuation allowance ...................... $544.8 $492.8

Deferred tax liabilities:

Property,plantandequipment .................................... (26.2) (45.6)

Other ....................................................... (19.1) (25.4)

Total........................................................ (45.3) (71.0)

Net deferred tax asset ............................................. $499.5 $421.8

Reported as:

Current deferred income tax asset ................................. $304.2 $286.6

Long-term deferred income tax asset (included in Other assets) ........... 195.3 135.2

Net deferred tax asset ............................................. $499.5 $421.8

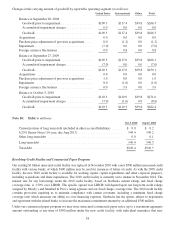

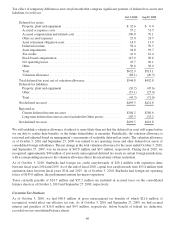

We will establish a valuation allowance if either it is more likely than not that the deferred tax asset will expire before

we are able to realize their benefits, or the future deductibility is uncertain. Periodically, the valuation allowance is

reviewed and adjusted based on management’s assessments of realizable deferred tax assets. The valuation allowance

as of October 3, 2010 and September 27, 2009 was related to net operating losses and other deferred tax assets of

consolidated foreign subsidiaries. The net change in the total valuation allowance for the years ended October 3, 2010,

and September 27, 2009, was an increase of $67.8 million and $0.3 million, respectively. During fiscal 2010, we

recognized approximately $40 million of previously unrecognized deferred tax assets in certain foreign jurisdictions,

with a corresponding increase to the valuation allowance due to the uncertainty of their realization.

As of October 3, 2010, Starbucks had foreign tax credit carryforwards of $26.1 million with expiration dates

between fiscal years 2014 and 2019. As of the end of fiscal 2010, capital loss carryforwards were $15.4 million with

expiration dates between fiscal years 2014 and 2015. As of October 3, 2010, Starbucks had foreign net operating

losses of $145.6 million, the predominant amount having no expiration.

Taxes currently payable of $24.7 million and $57.2 million are included in accrued taxes on the consolidated

balance sheets as of October 3, 2010 and September 27, 2009, respectively.

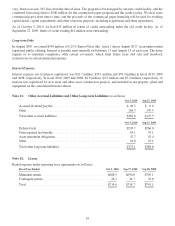

Uncertain Tax Positions

As of October 3, 2010, we had $68.4 million of gross unrecognized tax benefits of which $21.6 million, if

recognized, would affect our effective tax rate. As of October 3, 2010 and September 27, 2009, we had accrued

interest and penalties of $16.8 million and $9.9 million, respectively, before benefit of federal tax deduction,

recorded on our consolidated balance sheets.

66