Starbucks 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

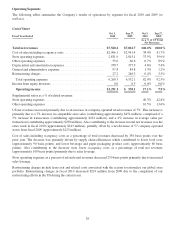

Company-operated retail revenues decreased primarily due to unfavorable foreign currency exchange rates,

particularly for the British pound and Canadian dollar. Partially offsetting the decrease were the net new store

openings during the fiscal year.

Specialty revenues decreased primarily due to continued softness in the hospitality industry and unfavorable foreign

currency exchange rates.

Operating margin decreased primarily due to higher restructuring charges and higher store operating expenses as a

percentage of total revenues. Restructuring charges of $27.0 million recognized during the year had a 50 basis point

impact on operating margin compared to the prior year, due to the previously announced store closures. Higher store

operating expenses as of percentage of company-operated retail revenues were driven by an increase in store

impairment charges and a decline in sales leverage impacting salaries and benefits. Partially offsetting the decrease

in operating margin were lower other operating expenses due to headcount reductions in the non-store support

functions.

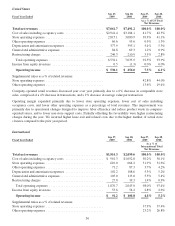

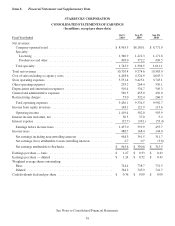

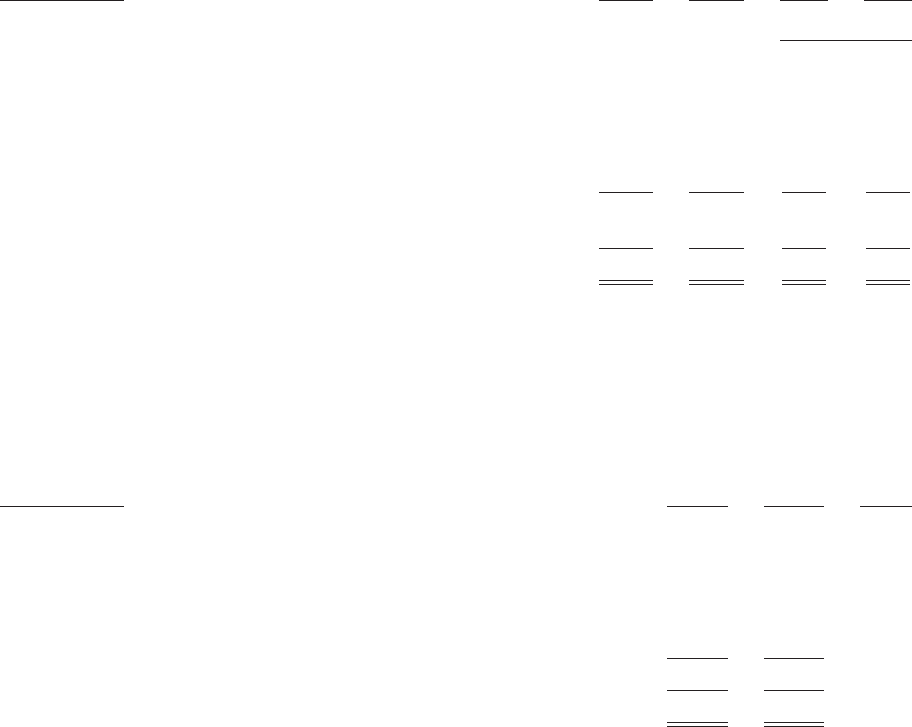

Global Consumer Products Group

Fiscal Year Ended

Sep 27,

2009

Sep 28,

2008

Sep 27,

2009

Sep 28,

2008

As a % of CPG

Total Net Revenues

Total specialty ............................................. $674.4 $680.9 100.0% 100.0%

Costofsales ............................................... $350.5 $344.5 52.0% 50.6%

Otheroperatingexpenses...................................... 95.3 113.8 14.1% 16.7%

Depreciationandamortizationexpenses .......................... 4.8 5.4 0.7% 0.8%

Generalandadministrativeexpenses ............................. 8.8 7.9 1.3% 1.2%

Restructuringcharges ........................................ 1.0 0.0 0.1% 0.0%

Totaloperatingexpenses .................................... 460.4 471.7 68.3% 69.3%

Incomefromequityinvestees .................................. 67.8 60.7 10.1% 8.9%

Operating income ........................................ $281.8 $269.9 41.8% 39.6%

Total net revenues increased primarily due to higher revenues from packaged coffees, partially offset by lower

foodservice revenues caused by continued softness in the hospitality industry.

Growth of operating margin was primarily due to lower other operating expenses in the foodservice business due to

lower compensation costs and lower marketing expenses.

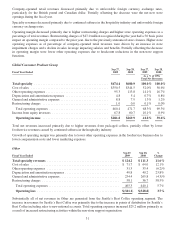

Other

Fiscal Year Ended

Sep 27,

2009

Sep 28,

2008

%

Change

Total specialty revenues ............................................ $ 124.2 $ 111.3 11.6%

Costofsales ...................................................... $ 71.7 $ 64.0 12.1%

Otheroperatingexpenses ............................................ 31.3 33.4 (6.2)%

Depreciationandamortizationexpenses ................................. 49.8 40.2 23.8%

Generalandadministrativeexpenses.................................... 254.4 265.8 (4.3)%

Restructuringcharges ............................................... 58.1 36.7 58.5%

Totaloperatingexpenses........................................... 465.3 440.1 5.7%

Operating loss .................................................. $(341.1) $(328.8) 3.7%

Substantially all of net revenues in Other are generated from the Seattle’s Best Coffee operating segment. The

increase in revenues for Seattle’s Best Coffee was primarily due to the increase in points of distribution for Seattle’s

Best Coffee including sales to new national accounts. Total operating expenses increased $25.2 million primarily as

a result of increased restructuring activities within the non-store support organization.

31