Starbucks 2010 Annual Report Download - page 55

Download and view the complete annual report

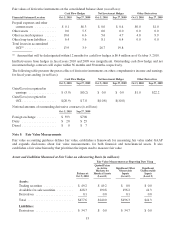

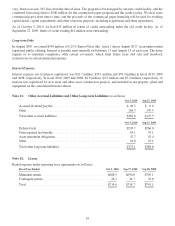

Please find page 55 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-based Compensation

Starbucks maintains several equity incentive plans under which we may grant non-qualified stock options, incentive

stock options, restricted stock, restricted stock units (“RSUs”) or stock appreciation rights to employees,

non-employee directors and consultants. We also have employee stock purchase plans (“ESPP”). RSUs issued by us

are equivalent to nonvested shares under the applicable accounting guidance.

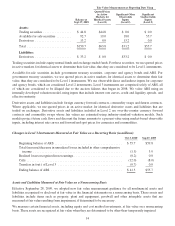

Foreign Currency Translation

Our international operations generally use their local currency as their functional currency. Assets and liabilities are

translated at exchange rates in effect at the balance sheet date. Income and expense accounts are translated at the

average monthly exchange rates during the year. Resulting translation adjustments are recorded as a component of

accumulated other comprehensive income on the consolidated balance sheets.

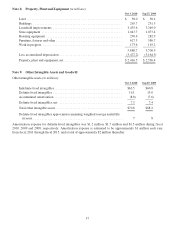

Income Taxes

We compute income taxes using the asset and liability method, under which deferred income taxes are provided for

the temporary differences between the financial statement carrying amounts and the tax basis of our assets and

liabilities. We will establish a valuation allowance for deferred tax assets if it is more likely than not that these items

will either expire before Starbucks is able to realize their benefits, or that future deductibility is uncertain.

Periodically, the valuation allowance is reviewed and adjusted based on management’s assessments of realizable

deferred tax assets. We recognize the tax benefit from an uncertain tax position only if it is more likely than not that

the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the

position. The tax benefits recognized in the financial statements from such a position are measured based on the

largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. Starbucks

recognizes interest and penalties related to income tax matters in income tax expense.

Earnings per Share

Basic earnings per share is computed on the basis of the weighted average number of shares and common stock units

that were outstanding during the period. Diluted earnings per share includes the dilutive effect of common stock

equivalents consisting of certain shares subject to stock options and RSUs, using the treasury stock method.

Performance-based RSUs are considered dilutive when the related performance criterion has been met.

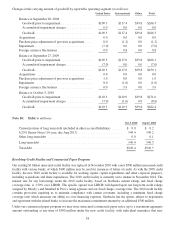

Common Stock Share Repurchases

We may repurchase shares of Starbucks common stock under a program authorized by our Board of Directors,

including pursuant to a contract, instruction or written plan meeting the requirements of Rule 10b5-1(c)(1) of the

Securities Exchange Act of 1934. Under applicable Washington State law, shares repurchased are retired and not

displayed separately as treasury stock on the financial statements. Instead, the par value of repurchased shares is

deducted from common stock and the excess repurchase price over par value is deducted from additional paid-in

capital and from retained earnings, once additional paid-in capital is depleted.

Recent Accounting Pronouncements

In 2007, the Financial Accounting Standards Board (“FASB”) issued authoritative guidance on accounting and

reporting for noncontrolling interests in subsidiaries. The guidance clarifies that a noncontrolling interest in a

subsidiary should be accounted for as a component of equity separate from the parent company’s equity. It also

requires the presentation of both net earnings attributable to non-controlling interests and net earnings attributable to

Starbucks on the face of the consolidated statement of earnings. We adopted the new guidance relating to

noncontrolling interests beginning September 28, 2009 on a prospective basis, except for the presentation and

disclosure requirements, which were applied retrospectively as follows:

• we reclassified minority interests previously reported on our consolidated statements of earnings as a

component of net interest income and other to a separate line below net earnings including noncontrolling

interests

49