Starbucks 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

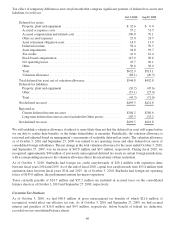

We have commitments under which we unconditionally guarantee our proportionate share of certain borrowings of

unconsolidated equity investees. These guarantees have varying expiration dates. As of October 3, 2010, our

maximum exposure under these commitments is $2.1 million, which excludes interest and other related costs. The

fair value of these guarantees as of October 3, 2010 is $2.2 million and is recorded our consolidated balance sheets.

Legal Proceedings

Starbucks is party to various legal proceedings arising in the ordinary course of business, but is not currently a party

to any legal proceeding that management believes would have a material adverse effect on our consolidated

financial position or results of operations.

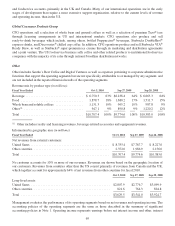

Note 18: Acquisitions

In the first quarter of fiscal 2010, we acquired 100% ownership of our business in France, converting it from a 50%

joint venture with Sigla S.A. (Grupo Vips) of Spain to a company-operated market. We simultaneously sold our

50% ownership interests in the Spain and Portugal markets to Grupo Vips, converting them to licensed markets.

In the fourth quarter of fiscal 2010, we acquired 100% ownership of our business in Brazil, converting it from a 49%

joint venture with Cafés Sereia do Brasil Participações S.A of Brazil to a company-operated market.

In the fourth quarter of fiscal 2010, we acquired 100% ownership of a previously consolidated 50% joint venture in

the US with Johnson Coffee Corporation, Urban Coffee Opportunities (“UCO”). The following table shows the

effects of the change in Starbucks ownership interest in UCO on Starbucks equity:

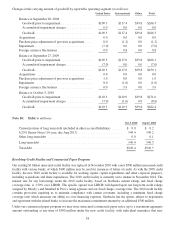

Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008

Net earnings attributable to Starbucks ............................. $945.6 $390.8 $315.5

Transfers (to) from the noncontrolling interest:

Decrease in additional paid-in capital for purchase of 50% interest in

subsidiary .............................................. (26.8) 0.0 0.0

Change from net earnings attributable to Starbucks and transfers to

noncontrolling interest ....................................... $918.8 $390.8 $315.5

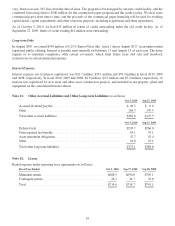

Note 19: Segment Reporting

Segment information is prepared on the same basis that our management reviews financial information for

operational decision making purposes. We have three reportable operating segments: US, International, and CPG. In

the fourth fiscal quarter of 2010, we changed the composition of our operating segments, presenting Seattle’s Best

Coffee as a separate operating segment that is now reported with Digital Ventures and unallocated corporate

expenses within Other. Financial information for Seattle’s Best Coffee was previously reported within the US,

International, and CPG segments. This change reflects the culmination of internal management and reporting

realignments, and the expected development of the Seattle’s Best Coffee business. Segment information for all prior

periods presented has been reclassified to reflect this change.

United States

US operations sell coffee and other beverages, complementary food, whole bean coffees, and a focused selection of

merchandise primarily through company-operated retail stores. Specialty operations within the US include licensed

retail stores.

International

International operations sell coffee and other beverages, complementary food, whole bean coffees, and a focused

selection of merchandise through company-operated retail stores in Canada, the UK, and several other markets.

Specialty operations in international markets primarily include retail store licensing operations in nearly 40 countries

68