Starbucks 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Our customers voted us the #1 Best

Coffee in the annual Zagat® survey.

We found a small way to make our

Starbucks Cards even more convenient.

2

3

We made sure our customers will

never be without great coffee.

4

STARBUCKS

CORPORATION

AUTHOR

FISCAL 2010

ANNUAL REPORT

TITLE

YEAR

Table of contents

-

Page 1

Our customers voted us the #1 Best Coffee in the annual Zagat ® survey. 1 4 2 We found a small way to make our Starbucks Cards even more convenient. 3 We made sure our customers will never be without great coffee. AUTHOR TITLE STARBUCKS CORPORATION ANNUAL REPORT YEAR FISCAL 2010 -

Page 2

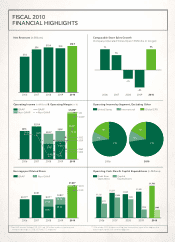

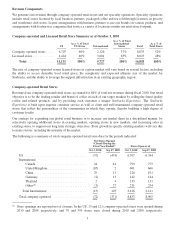

FISCAL 2010 FINANCIAL HIGHLIGHTS Net Revenues (in Billions) $10.4 $10.7 $9.8 7% 5% 7% Comparable Store Sales Growth (Company-Operated Stores Open 13 Months or Longer) $9.4 $7.8 -3% -6% 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 Operating Income (in Millions) & Operating Margin (in %) ... -

Page 3

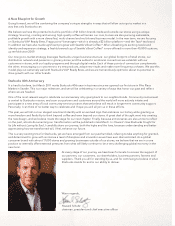

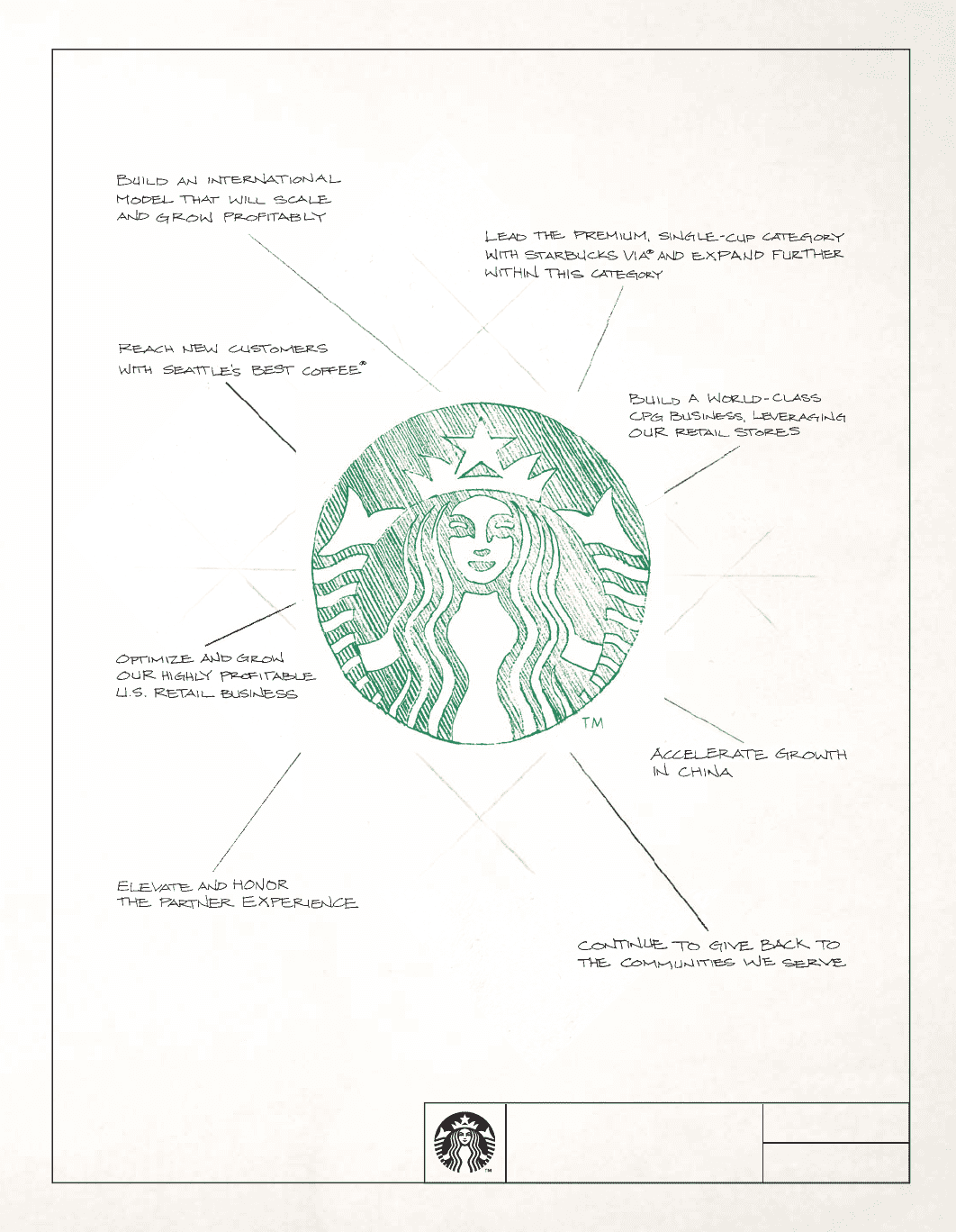

...U.S. business, revenues and operating income are growing again, with our store partners working passionately to elevate the Starbucks Experience. We had broad-based revenue growth in our Global Consumer Products Group (CPG) and we are also well on our way to building a world-class sales organization... -

Page 4

... and expansion strategy, a freshly brewed cup of Seattle's Best Coffee® is now offered in more than 40,000 locations, up tenfold since 2009. Our new go-to-market strategy leverages Starbucks unique business structure: our global footprint of retail stores; our distribution network and presence... -

Page 5

..., Washington 98134 (206) 447-1575 (Address of principal executive offices, zip code, telephone number) Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.001 par value per share Nasdaq Global Select Market... -

Page 6

...Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations ...Item 7A Quantitative and Qualitative Disclosures About Market Risk ...Item 8 Financial Statements and Supplementary Data ...Report of Independent Registered Public Accounting Firm ...Item 9 Changes in and... -

Page 7

... and "Management's Discussion and Analysis of Financial Condition and Results of Operations". Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this Annual Report on Form... -

Page 8

... Global Consumer Products Group ("CPG"). In the fourth fiscal quarter of 2010, we changed the composition of our reportable segments by creating a Seattle's Best Coffee operating segment and reporting it with our unallocated corporate expenses and Digital Ventures in "Other". Financial information... -

Page 9

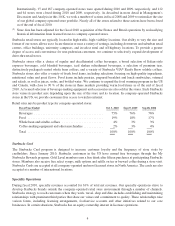

...company-operated retail stores accounted for 84% of total net revenues during fiscal 2010. Our retail objective is to be the leading retailer and brand of coffee in each of our target markets by selling the finest quality coffee and related products, and by providing each customer a unique Starbucks... -

Page 10

... the size of the store and its location. In company-operated Starbucks stores in the US, we provide customers free access to wireless internet. Retail sales mix by product type for company-operated stores: Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Beverages ...Food ...Whole bean and... -

Page 11

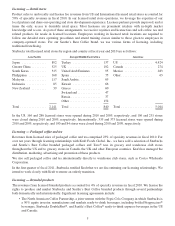

... and 2009, respectively. Licensing - Packaged coffee and tea Revenues from licensed sales of packaged coffee and tea comprised 23% of specialty revenues in fiscal 2010. For over ten years through licensing relationships with Kraft Foods Global, Inc., we have sold a selection of Starbucks and Seattle... -

Page 12

...total specialty revenues in fiscal 2010. We sell whole bean and ground coffees, including the Starbucks and Seattle's Best Coffee brands, as well as a selection of premium Tazo® teas, Starbucks VIA® Ready Brew and other related products, to institutional foodservice companies that service business... -

Page 13

... retail stores are obtained through a number of different channels. Beverage ingredients other than coffee and milk, including leaf teas as well as our selection of ready-to-drink beverages, are purchased from several specialty suppliers, usually under long-term supply contracts. Food products, such... -

Page 14

... Seattle's Best Coffee president, Global Development chief marketing officer chief financial officer and chief administrative officer executive vice president, general counsel and secretary executive vice president, Global Supply Chain Operations executive vice president, Partner Resources executive... -

Page 15

... vice president, Global Manufacturing Operations. From March 1999 to February 2007, Mr. Gibbons was executive vice president, Supply Chain, of The Glidden Company, a subsidiary of ICI Americas, Inc. Kalen Holmes joined Starbucks in November 2009 as executive vice president, Partner Resources. Prior... -

Page 16

... communications and public relations in Microsoft's Corporate Marketing Group. There are no family relationships among any of our directors or executive officers. Global Responsibility We are committed to being a deeply responsible company in the communities where we do business around the world... -

Page 17

... operations are sensitive to changes in macro-economic conditions. Our customers may have less money for discretionary purchases as a result of job losses, foreclosures, bankruptcies, increased fuel and energy costs, higher interest rates, higher taxes, reduced access to credit and lower home prices... -

Page 18

... licensing relationships with Kraft Foods Global, Inc.; • balancing disciplined global store growth while meeting target store-level unit economics in a given market; and • executing a multi-channel advertising and marketing campaign to effectively communicate our message directly to Starbucks... -

Page 19

Our International operations are also subject to additional inherent risks of conducting business abroad, such as: • foreign currency exchange rate fluctuations; • changes or uncertainties in economic, legal, regulatory, social and political conditions in our markets; • interpretation and ... -

Page 20

... relationships, particularly in our International markets. Licensees are often authorized to use our logos and provide branded beverages, food and other products directly to customers. We provide training and support to, and monitor the operations of, these business partners, but the product... -

Page 21

... raw materials, to locate and hire sufficient numbers of key employees to meet our financial targets, to maintain an effective system of internal controls for a globally dispersed enterprise and to train employees worldwide to deliver a consistently high quality product and customer experience. 15 -

Page 22

... on information technology systems across our operations, including for management of our supply chain, point-of-sale processing in our stores, Starbucks Cards, online business and various other processes and transactions. Our ability to effectively manage our business and coordinate the production... -

Page 23

... stock dividend; or • reduce or delay planned capital or operating expenditures. Such measures might not be sufficient to enable us to satisfy our financial obligations. In addition, any such financing, refinancing or sale of assets might not be available on economically favorable terms. Item... -

Page 24

... Purchases of Equity Securities SHAREHOLDER INFORMATION MARKET INFORMATION AND DIVIDEND POLICY Starbucks common stock is traded on NASDAQ, under the symbol "SBUX." The following table shows the quarterly high and low closing sale prices per share of Starbucks common stock as reported by NASDAQ... -

Page 25

... date. The stock price performance shown in the graph is not necessarily indicative of future price performance. $250 $200 Starbucks Corporation S&P 500 NASDAQ Composite S&P Consumer Discretionary $150 $100 $50 $0 10/2/2005 10/1/2006 9/30/2007 10/2/05 9/28/2008 10/1/06 9/30/07 9/27/2009... -

Page 26

... declared per share ...Net cash provided by operating activities ...Capital expenditures (additions to property, plant and equipment) ...BALANCE SHEET Total assets ...Short-term borrowings ...Long-term debt (including current portion) ...Shareholders' equity ...STORE INFORMATION Percentage change in... -

Page 27

...Fiscal Year Ended(1) Oct 3, 2010 (53 Wks) Sep 27, 2009 (52 Wks) Sep 28, 2008 (52 Wks) Sep 30, 2007 (52 Wks) Oct 1, 2006 (52 Wks) Stores open at year end: United States Company-operated stores ...Licensed stores ...International Company-operated stores ...Licensed stores ...Total ...(1) 6,707... -

Page 28

... and Analysis of Financial Condition and Results of Operations Starbucks Corporation's fiscal year ends on the Sunday closest to September 30. The fiscal year ended on October 3, 2010 included 53 weeks with the 53rd week falling in our fourth fiscal quarter. Fiscal years ended on September 27, 2009... -

Page 29

..., International, and CPG. In the fourth fiscal quarter of 2010, we changed the composition of our reportable segments by creating a Seattle's Best Coffee operating segment and reporting it with our unallocated corporate expenses and Digital Ventures in Other. Financial information for Seattle's Best... -

Page 30

... statements in this 10-K. RESULTS OF OPERATIONS - FISCAL 2010 COMPARED TO FISCAL 2009 Consolidated results of operations (in millions): Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 % Change Oct 3, Sep 27, 2010 2009 % of Total Net Revenues Net revenues: Company-operated retail ...Specialty: Licensing... -

Page 31

... of the Company's liability under the Management Deferred Compensation Plan ("MDCP"). The MDCP liability also increases and decreases with changes in investment performance, with this offsetting impact recorded in general and administrative expenses on the consolidated statements of earnings. This... -

Page 32

...fiscal 2010 and 2009 (in millions). United States Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Oct 3, Sep 27, 2010 2009 As a % of US Total Net Revenues Total net revenues ...$7,560.4 Cost of sales including occupancy costs ...$2,906.1 Store operating expenses ...2,831.9 Other operating expenses ...55... -

Page 33

...Year Ended Oct 3, 2010 Sep 27, 2009 Oct 3, Sep 27, 2010 2009 As a % of International Total Net Revenues Total net revenues ...$2,288.8 Cost of sales including occupancy costs ...$1,078.2 Store operating expenses ...719.5 Other operating expenses ...85.7 Depreciation and amortization expenses ...108... -

Page 34

... expenses included in Other relate to Seattle's Best Coffee and Digital Ventures as well as expenses pertaining to corporate administrative functions that support our operating segments but are not specifically attributable to or managed by any segment and are not included in the reported financial... -

Page 35

... efficiency and reduced product waste in company-operated stores, partially offset by increased restructuring charges. Fiscal Year Ended Sep 27, 2009 Sep 28, 2008 Sep 27, Sep 28, 2009 2008 % of Total Net Revenues Operating income ...Interest income and other, net ...Interest expense ...Earnings... -

Page 36

... higher lease exit and related costs due to the higher number of actual store closures compared to the prior year period. International Fiscal Year Ended Sep 27, 2009 Sep 28, 2008 Sep 27, Sep 28, 2009 2008 As a % of International Total Net Revenues Total net revenues ...Cost of sales including... -

Page 37

...primarily due to lower other operating expenses in the foodservice business due to lower compensation costs and lower marketing expenses. Other Fiscal Year Ended Sep 27, 2009 Sep 28, 2008 % Change Total specialty revenues ...Cost of sales ...Other operating expenses ...Depreciation and amortization... -

Page 38

... fiscal quarters respectively. FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES Starbucks cash and short-term investments were $1.4 billion and $666 million as of October 3, 2010 and September 27, 2009, respectively. We actively manage our cash and short-term investments in order to internally... -

Page 39

... stores, and investment in information technology systems. Cash used by financing activities for fiscal 2010 totaled $346 million as compared to $642 million in fiscal 2009. The change primarily reflects net repayments of commercial paper and short-term borrowings under the credit facility totaling... -

Page 40

... business. Off-Balance Sheet Arrangement Off-balance sheet arrangements relate to certain guarantees and are detailed in Note 17 to the consolidated financial statements in this 10-K. COMMODITY PRICES, AVAILABILITY AND GENERAL RISK CONDITIONS Commodity price risk represents Starbucks primary market... -

Page 41

...-fixed contracts for coffee purchases, we have entered into commodity hedges to manage commodity price risk using financial derivative instruments. We performed a sensitivity analysis based on a 10% change in the underlying commodity prices of our commodity hedges, as of the end of fiscal 2010, and... -

Page 42

... cash flow model based on future store revenues and operating costs, using internal projections. For other assets, we use the valuation approach that is appropriate given the relevant facts and circumstances. Our impairment loss calculations contain uncertainties because they require management... -

Page 43

... on that date do not constitute an integrated set of assets that are capable of being conducted and managed for the purpose of providing a return to investors. As a result, when closing individual stores, we do not include goodwill in the calculation of any loss on disposal of the related assets. As... -

Page 44

... "Management's Discussion and Analysis of Financial Condition and Results of Operations - Commodity Prices, Availability and General Risk Conditions" and "Management's Discussion and Analysis of Financial Condition and Results of Operations - Financial Risk Management" in Item 7 of this Report... -

Page 45

...STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (In millions, except per share data) Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Net revenues: Company-operated retail ...Specialty: Licensing ...Foodservice and other ...Total specialty ...Total net revenues ...Cost of sales... -

Page 46

... CORPORATION CONSOLIDATED BALANCE SHEETS (In millions, except per share data) Oct 3, 2010 Sep 27, 2009 ASSETS Current assets: Cash and cash equivalents ...$1,164.0 Short-term investments - available-for-sale securities ...236.5 Short-term investments - trading securities ...49.2 Accounts receivable... -

Page 47

...issuance of common stock ...Excess tax benefit from exercise of stock options ...Principal payments on long-term debt ...Cash dividends paid ...Repurchase of common stock ...Other ...Net cash used by financing activities ...Effect of exchange rate changes on cash and cash equivalents ...Net increase... -

Page 48

STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EQUITY (In millions) Other Accumulated Additional Other Common Stock Additional Paid-in Paid-in Retained Comprehensive Shareholders' Noncontrolling Shares Amount Capital Capital Earnings Income/(Loss) Equity Interest $0.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 ... -

Page 49

... Accounting Policies Description of Business Starbucks purchases and roasts high-quality whole bean coffees and sells them, along with handcrafted coffee and tea beverages and a variety of fresh food items, through its company-operated retail stores. We also sell coffee and tea products and license... -

Page 50

... losses are accounted for using the specific identification method. Purchases and sales are recorded on a trade date basis. Fair Value of Financial Instruments and Equity and Cost Investments The carrying value of cash and cash equivalents approximates fair value because of the short-term maturity... -

Page 51

...on the consolidated statements of earnings. Allowance for Doubtful Accounts Allowance for doubtful accounts is calculated based on historical experience, customer credit risk and application of the specific identification method. As of October 3, 2010, September 27, 2009, and September 28, 2008, the... -

Page 52

... 2010, 2009 and 2008, respectively, primarily due to underperforming company-operated retail stores. The net losses in fiscal 2009 and 2008 include $129.2 million and $201.6 million, respectively, of asset impairments related primarily to the US and International store closures as part of Starbucks... -

Page 53

... company-operated retail stores, as well as royalties and other fees generated from licensing operations. Sales of coffee, tea and related products are generally recognized upon shipment to customers, depending on contract terms. Shipping charges billed to customers are also recognized as revenue... -

Page 54

... of earnings, totaled $176.2 million, $126.3 million and $129.0 million in fiscal 2010, 2009 and 2008, respectively. As of October 3, 2010 and September 27, 2009, $5.6 million and $7.2 million, respectively, of capitalized advertising costs were recorded on the consolidated balance sheets. Store... -

Page 55

... Share Repurchases We may repurchase shares of Starbucks common stock under a program authorized by our Board of Directors, including pursuant to a contract, instruction or written plan meeting the requirements of Rule 10b5-1(c)(1) of the Securities Exchange Act of 1934. Under applicable Washington... -

Page 56

... (in millions): By Type of Cost Lease Exit and Other Asset Related Costs Impairments By Segment Employee Termination Costs Total US International Other Costs incurred and charged to expense in fiscal 2010 ...$ 53.0 Costs incurred and charged to expense in fiscal 2009 ...332.4 Costs incurred and... -

Page 57

... fiscal years 2010, 2009 and 2008, realized gains and losses on sales and maturities were immaterial. As of October 3, 2010, long-term available-for-sale securities of $191.8 million included $41.3 million invested in auction rate securities ("ARS"). As of September 27, 2009, long-term available-for... -

Page 58

... balance sheets. The changes in net unrealized holding gains/losses in the trading portfolio included in earnings for fiscal years 2010 and 2009 were a net gain of $4.1 million and a net loss of $4.9 million, respectively. Note 4: Derivative Financial Instruments Cash Flow Hedges Starbucks... -

Page 59

...): Financial Statement Location Cash Flow Hedges Oct 3, 2010 Sep 27, 2009 Net Investment Hedges Oct 3, 2010 Sep 27, 2009 Other Derivatives Oct 3, 2010 Sep 27, 2009 Prepaid expenses and other current assets ...Other assets ...Other accrued expenses ...Other long-term liabilities ...Total losses in... -

Page 60

... value using market-based observable inputs, including interest rate curves and forward and spot prices for currencies and commodities. Changes in Level 3 Instruments Measured at Fair Value on a Recurring Basis (in millions): Oct 3, 2010 Sep 27, 2009 Beginning balance of ARS ...Total (increase... -

Page 61

....9 Levels of inventory vary due to seasonality driven primarily by the holiday season, commodity market supply and price variations, and changes in our use of fixed-price and price-to-be-fixed coffee contracts. As of October 3, 2010, we had committed to purchasing green coffee totaling $156 million... -

Page 62

...from equity investees, respectively, on our consolidated balance sheets, primarily related to product sales and store license fees. As of October 3, 2010, the aggregate market value of our investment in Starbucks Japan was approximately $286 million, based on its available quoted market price, which... -

Page 63

... $68.2 8 Amortization expense for definite-lived intangibles was $1.2 million, $1.7 million and $1.5 million during fiscal 2010, 2009 and 2008, respectively. Amortization expense is estimated to be approximately $1 million each year from fiscal 2011 through fiscal 2015, and a total of approximately... -

Page 64

..., capital expenditures and other corporate purposes, including acquisitions and share repurchases. The 2010 credit facility is currently set to mature in November 2014. The interest rate for any borrowings under the 2010 credit facility, based on Starbucks current ratings and fixed charge coverage... -

Page 65

...tax benefits ...Asset retirement obligations ...Other ...Total other long term liabilities ... $239.7 65.1 47.7 22.6 $375.1 $266.0 55.1 43.4 25.1 $389.6 Note 12: Leases Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Rental expense under operating lease agreements (in millions): Fiscal Year Ended Minimum... -

Page 66

...long-term liabilities on the consolidated balance sheets. Assets held under capital leases are included in net property, plant and equipment on the consolidated balance sheets. Note 13: Shareholders' Equity In addition to 1.2 billion shares of authorized common stock with $0.001 par value per share... -

Page 67

Comprehensive income, net of related tax effects (in millions): Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Net earnings attributable to Starbucks ...Unrealized holding gains/(losses) on available-for-sale securities, net of tax (provision)/benefit of $0.1, $(1.9) and $2.4, respectively... -

Page 68

... in the consolidated financial statements (in millions): Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Options ...RSUs ...ESPP ...Total stock-based compensation expense on the consolidated statements of earnings ...Total related tax benefit ...Stock-based compensation capitalized in the... -

Page 69

... to receive shares of common stock if we achieve specified performance goals for the full fiscal year in the year of award and the grantee remains employed during the subsequent vesting period. The fair value of RSUs is based on the closing price of Starbucks common stock on the award date. Expense... -

Page 70

... stock, subject to an annual maximum dollar amount. The purchase price is 95% of the fair market value of the stock on the last business day of the quarterly offering period. The number of shares issued under our ESPP was 0.8 million in fiscal 2010. Deferred Stock Plan We have a deferred stock plan... -

Page 71

... with our effective income tax rate: Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Statutory rate ...State income taxes, net of federal income tax benefit ...Foreign earnings taxed at lower rates ...Domestic production activity deduction ...Credit resulting from employment audit ...Other... -

Page 72

... tax assets: Property, plant and equipment ...Accrued occupancy costs ...Accrued compensation and related costs ...Other accrued expenses ...Asset retirement obligation asset ...Deferred revenue ...Asset impairments ...Tax credits ...Stock based compensation ...Net operating losses ...Other ...Total... -

Page 73

... 16: Earnings per Share Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Calculation of net earnings per common share ("EPS") - basic and diluted (in millions, except EPS): Fiscal Year Ended Net earnings attributable to Starbucks ...Weighted average common shares and common stock units outstanding (for basic... -

Page 74

..., International, and CPG. In the fourth fiscal quarter of 2010, we changed the composition of our operating segments, presenting Seattle's Best Coffee as a separate operating segment that is now reported with Digital Ventures and unallocated corporate expenses within Other. Financial information for... -

Page 75

... to or managed by any segment, and are not included in the reported financial results of the operating segments. Revenue mix by product type (in millions): Fiscal Year Ended Oct 3, 2010 Sep 27, 2009 Sep 28, 2008 Beverage ...Food ...Whole bean and soluble coffees ...Other(1) ...Total ...(1) $ 6,750... -

Page 76

...with Kraft, Starbucks sells a selection of Starbucks and Seattle's Best Coffee branded packaged coffees and Tazo® teas in grocery and warehouse club stores throughout the US, and to grocery stores in Canada, the UK and other European countries. Kraft manages the distribution, marketing, advertising... -

Page 77

... of Directors and Shareholders of Starbucks Corporation Seattle, Washington We have audited the accompanying consolidated balance sheets of Starbucks Corporation and subsidiaries (the "Company") as of October 3, 2010 and September 27, 2009, and the related consolidated statements of earnings, equity... -

Page 78

...that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective, as of the end of the period covered by this report (October 3, 2010). During the fourth quarter of fiscal 2010, there were no changes in our internal control... -

Page 79

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Starbucks Corporation Seattle, Washington We have audited the internal control over financial reporting of Starbucks Corporation and subsidiaries (the "Company") as of October 3, 2010, based on criteria... -

Page 80

... 1 - Election Of Directors" and "Executive Compensation - Section 16(a) Beneficial Ownership Reporting Compliance" and "Corporate Governance - Board Committees and Related Matters" in our definitive Proxy Statement for the Annual Meeting of Shareholders to be held on March 23, 2011 (the "Proxy... -

Page 81

...are filed as a part of this 10-K: 1. Financial Statements The following financial statements are included in Part II, Item 8 of this 10-K: • Consolidated Statements of Earnings for the fiscal years ended October 3, 2010, September 27, 2009 and September 28, 2008; • Consolidated Balance Sheets as... -

Page 82

... this report to be signed on its behalf by the undersigned, thereunto duly authorized. STARBUCKS CORPORATION By: /s/ Howard Schultz Howard Schultz chairman, president and chief executive officer November 22, 2010 POWER OF ATTORNEY Know all persons by these presents, that each person whose signature... -

Page 83

Signature Title By: /s/ Sheryl Sandberg Sheryl Sandberg By: /s/ James G. Shennan Jr. James G. Shennan Jr. By: /s/ Javier G. Teruel Javier G. Teruel By: /s/ Myron E. Ullman III Myron E. Ullman III By: /s/ Craig E. Weatherup Craig E. Weatherup director director director director director 77 -

Page 84

... Management Deferred Compensation Plan Starbucks Corporation 1997 Deferred Stock Plan Starbucks Corporation UK Share Save Plan Starbucks Corporation Directors Deferred Compensation Plan, as amended and restated effective September 29, 2003 Consulting Agreement dated April 6, 2009 between Starbucks... -

Page 85

... of Stock under the 2005 Non-Employee Director Sub-Plan to the Starbucks Corporation 2005 Long-Term Equity Incentive Plan Letter Agreement dated February 5, 2009 between Starbucks Corporation and John Culver 2005 Company-Wide Sub-Plan to the Starbucks Corporation 2005 Long-Term Equity Incentive Plan... -

Page 86

... Unit Agreement (International) under Starbucks Corporation 2005 Long-Term Equity Incentive Plan Performance Based Restricted Stock Unit Agreement under Starbucks Corporation 2005 Long-Term Equity Incentive Plan Separation Agreement and Release dated November 30, 2009 between Starbucks Corporation... -

Page 87

... Condensed Consolidated Statements of Earnings, (ii) Condensed Consolidated Balance Sheets, (iii) Condensed Consolidated Statements of Cash Flows (iv) Consolidated Statements of Equity (v) Notes to Condensed Consolidated Financial Statements * Denotes a management contract or compensatory plan or... -

Page 88

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 89

...via the address, phone number or website listed below. Investor Relations Starbucks Corporation PO Box 34067 M/S S-SR1 Seattle, WA 98124-1067 (206) 318-7118 http://investor.starbucks.com Independent Auditors Deloitte & Touche LLP Transfer Agent BNY Mellon Shareowner Services Starbucks Coffee Company... -

Page 90

...true to the core values and authenticity that are key to our continued success. As we look forward, this evolution is just one important step toward achieving our strategic goals and continuing to grow Starbucks. The best is yet to come. © 2011 STARBUCKS CORPORATION. ALL RIGHTS RESERVED. SJBQ411OTH...