Singapore Airlines 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

077ANNUAL REPORT 2011/2012

Financial Review

Performance of the Subsidiary Companies (continued)

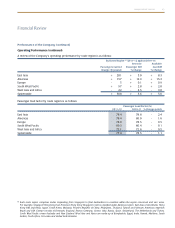

SIA Engineering Group (continued)

Share of profits of associated and joint venture companies increased $13 million or 8.7 per cent to $157 million, representing

a contribution of 51.8 per cent to SIAEC Group’s pre-tax profits.

Net profit of $269 million for 2011-12 was $11 million (+4.1 per cent) higher than the previous financial year.

As at 31 March 2012, SIAEC Group’s total equity amounted to $1,254 million, a decrease of $48 million (-3.7 per cent) from a

year ago. Correspondingly, net asset value per share fell 5.1 cents (-4.3 per cent) to $1.14 as at 31 March 2012.

Basic earnings per share increased 0.8 cents (+3.3 per cent) to 24.6 cents.

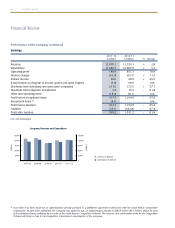

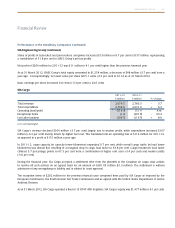

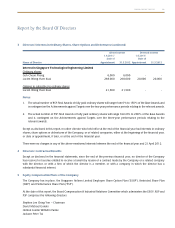

SIA Cargo

2011-12 2010-11

$million $million %Change

Total revenue 2,679.5 2,783.3 - 3.7

Total expenditure 2,798.8 2,631.9 + 6.3

Operating (loss)/profit (119.3) 151.4 n.m.

Exceptional items (1.3) (201.8) - 99.4

Loss after taxation (106.5) (116.5) + 8.6

n.m. not meaningful

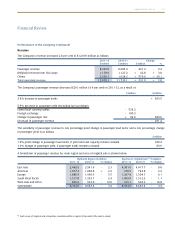

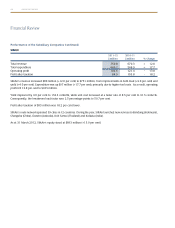

SIA Cargo’s revenue declined $104 million (-3.7 per cent) largely due to weaker yields, while expenditure increased $167

million (+6.3 per cent) mainly driven by higher fuel cost. This translated into an operating loss of $119 million for 2011-12,

as opposed to a profit of $151 million a year ago.

In 2011-12, cargo capacity (in capacity tonne kilometers) expanded 0.7 per cent, while overall cargo traffic (in load tonne

kilometers) was almost flat, resulting in a marginal drop in cargo load factor to 63.8 per cent. Cargo breakeven load factor

climbed 5.7 percentage points to 67.3 per cent from a combination of higher unit cost (+5.4 per cent) and weaker yields

(-3.6 per cent).

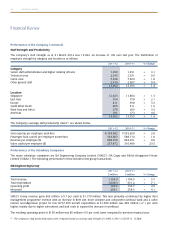

During the financial year, SIA Cargo accepted a settlement offer from the plaintiffs in the Canadian air cargo class actions

to resolve all such actions on an agreed basis for an amount of CAD1.05 million ($1.3 million). The settlement is without

admission of any wrongdoing or liability and is subject to court approval.

The exception items of $202 million for the previous financial year comprised fines paid by SIA Cargo as imposed by the

European Commission, the South Korean Fair Trade Commission and as agreed with the United States Department of Justice

Antitrust Division.

As at 31 March 2012, SIA Cargo operated a fleet of 13 B747-400 freighters. SIA Cargo’s equity was $1,477 million (-6.1 per cent).