Singapore Airlines 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164 SINGAPORE AIRLINES

Notes to the Financial Statements

31 March 2012

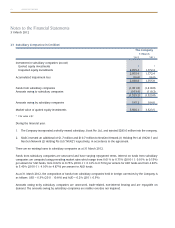

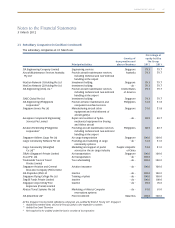

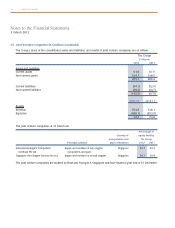

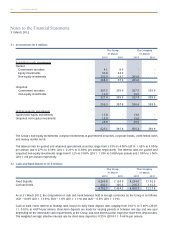

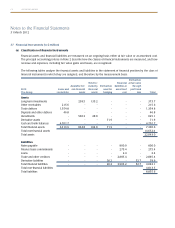

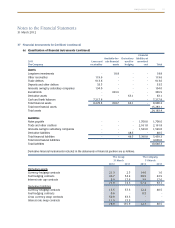

31 Investments (in $ million)

The Group The Company

31 March 31 March

2012 2011 2012 2011

Available-for-sale investments

Quoted

Government securities 4.1 8.9 - -

Equity investments 32.8 34.3 - -

Non-equity investments 232.0 14.7 209.0 -

268.9 57.9 209.0 -

Unquoted

Government securities 307.5 339.9 307.5 339.9

Non-equity investments 19.9 - 19.9 -

327.4 339.9 327.4 339.9

596.3 397.8 536.4 339.9

Held-to-maturity investments

Quoted non-equity investments 13.8 - 13.8 -

Unquoted non-equity investments 15.0 - 15.0 -

28.8 - 28.8 -

625.1 397.8 565.2 339.9

The Group’s non-equity investments comprise investments in government securities, corporate bonds, credit-linked notes

and money market funds.

The interest rates for quoted and unquoted government securities range from 1.63% to 4.00% (2011: 1.63% to 4.00%)

per annum and 0.27% to 0.39% (2011: 0.27% to 0.38%) per annum respectively. The interest rates for quoted and

unquoted non-equity investments range from 0.12% to 5.88% (2011: 1.10% to 5.88%) per annum and 1.00% to 1.06%

(2011: nil) per annum respectively.

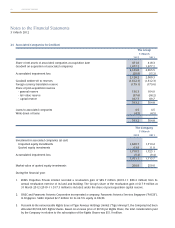

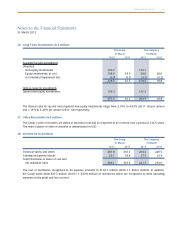

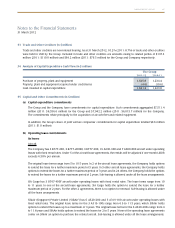

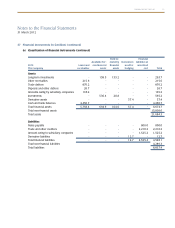

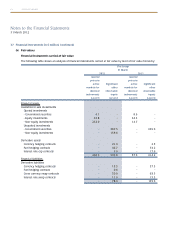

32 Cash and Bank Balances (in $ million)

The Group The Company

31 March 31 March

2012 2011 2012 2011

Fixed deposits 4,260.6 7,128.9 4,234.0 7,102.3

Cash and bank 442.1 305.3 216.7 115.5

4,702.7 7,434.2 4,450.7 7,217.8

As at 31 March 2012, the composition of cash and bank balances held in foreign currencies by the Group is as follows:

USD –10.8% (2011: 13.8%), EUR – 1.6% (2011: 1.1%) and AUD – 0.8% (2011: 1.1%).

Cash at bank earns interest at floating rates based on daily bank deposit rates ranging from 0.01% to 5.40% (2010-

11: 0.01% to 4.87%) per annum. Short-term deposits are made for varying periods of between one day and one year

depending on the immediate cash requirements of the Group, and earn interest at the respective short-term deposit rates.

The weighted average effective interest rate for short-term deposits is 0.55% (2010-11: 0.46%) per annum.