Singapore Airlines 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206

|

|

154 SINGAPORE AIRLINES

Notes to the Financial Statements

31 March 2012

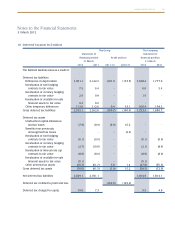

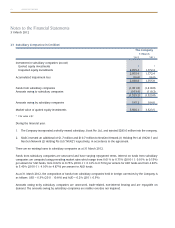

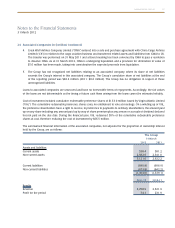

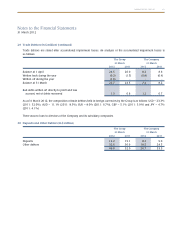

23 Subsidiary Companies (in $ million)

The Company

31 March

2012 2011

Investment in subsidiary companies (at cost)

Quoted equity investments # #

Unquoted equity investments 2,055.4 1,772.4

2,055.4 1,772.4

Accumulated impairment loss (16.6) (16.6)

2,038.8 1,755.8

Funds from subsidiary companies (1,361.8) (1,418.8)

Amounts owing to subsidiary companies (163.4) (110.2)

(1,525.2) (1,529.0)

Amounts owing by subsidiary companies 195.2 194.0

Market value of quoted equity investments 3,506.1 3,523.5

# The value is $1.

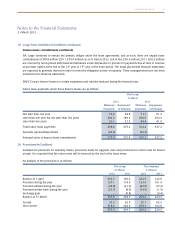

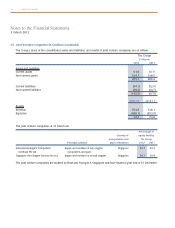

During the financial year:

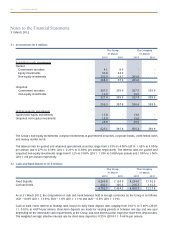

1. The Company incorporated a wholly-owned subsidiary, Scoot Pte. Ltd., and injected $283.0 million into the company.

2. SIAEC invested an additional of $1.7 million and $10.7 million to NexGen Network (1) Holding Pte Ltd (“NGN1”) and

NexGen Network (2) Holding Pte Ltd (“NGN2”) respectively, in accordance to the agreement.

There are no existing loans to subsidiary companies as at 31 March 2012.

Funds from subsidiary companies are unsecured and have varying repayment terms. Interest on funds from subsidiary

companies are computed using prevailing market rates which range from 0.01% to 0.75% (2010-11: 0.01% to 0.55%)

per annum for SGD funds, from 0.02% to 0.75% (2010-11: 0.14% to 0.73%) per annum for USD funds and from 4.40%

to 5.40% (2010-11: 4.10% to 4.87%) per annum for AUD funds.

As at 31 March 2012, the composition of funds from subsidiary companies held in foreign currencies by the Company is

as follows: USD – 6.3% (2011: 10.8%) and AUD – 0.2% (2011: 0.3%).

Amounts owing to/by subsidiary companies are unsecured, trade-related, non-interest bearing and are repayable on

demand. The amounts owing by subsidiary companies are neither overdue nor impaired.