Singapore Airlines 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 SINGAPORE AIRLINES

Notes to the Financial Statements

31 March 2012

2 Summary of Significant Accounting Policies (continued)

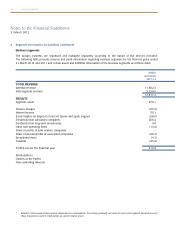

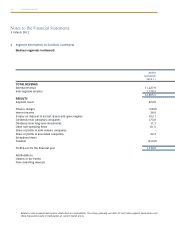

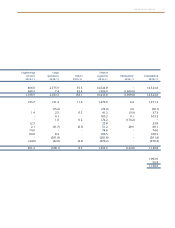

(ah) Segment reporting (continued)

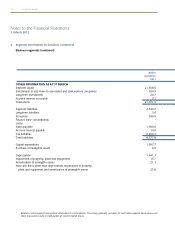

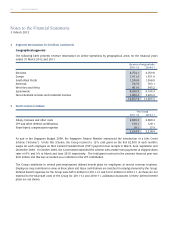

(ii) Geographical segment

The analysis of revenue by area of original sale from airline operations is derived by allocating revenue to

the area in which the sale was made. Revenue from other operations, which consist principally of engineering

services and cargo operations, is derived in East Asia and therefore, is not shown.

Assets, which consist principally of flight and ground equipment, support the entire worldwide transportation

system, and are mainly located in Singapore. An analysis of assets and capital expenditure of the Group by

geographical distribution has therefore not been included.

3 Significant Accounting Estimates

Estimates and assumptions concerning the future are made in the preparation of the financial statements. They affect

the application of the Group’s accounting policies, reported amounts of assets, liabilities, income and expenses, and

disclosures made. They are assessed on an ongoing basis and are based on experience and relevant factors, including

expectations of future events that are believed to be reasonable under the circumstances.

The key assumptions concerning the future and other key sources of estimation uncertainty at the end of the reporting

period that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within

the next financial year are discussed below.

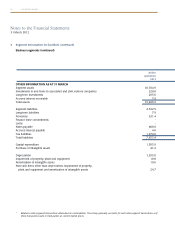

(a) Impairment of property, plant and equipment – aircraft fleet

Impairment is recognised when events and circumstances indicate that the aircraft may be impaired and the carrying

amounts of the aircraft exceed the recoverable amounts. Recoverable amount is defined as the higher of an aircraft’s

fair value less costs to sell and its value-in-use. The fair value less costs to sell computation is based on available

data from binding sales transactions in an arm’s length transaction of similar assets or observable market prices less

incremental costs for disposing the asset. In determining the recoverable amounts of the aircraft, certain estimates

regarding the current fair market value of the aircraft are made. The current fair market value is determined based

on desktop valuations from an independent appraisal for fleet with similar operational lives. When value-in-use

calculations are undertaken, the Group uses discounted cash flow projections based on financial budgets approved

by the management covering a specified period.

(b) Depreciation of property, plant and equipment – aircraft fleet

Aircraft are depreciated on a straight-line basis at rates which are calculated to write-down their cost to their estimated

residual values at the end of their operational lives. Certain estimates regarding the operational lives and residual values of

the fleet are made by the Group based on past experience and these are in line with the industry. The operational lives and

residual values are reviewed on an annual basis. The carrying amount of the Group’s and the Company’s aircraft fleet at 31

March 2012 was $11,024.2 million (2011: $11,111.9 million) and $8,985.5 million (2011: $9,137.5 million) respectively.

(c) Passenger revenue recognition

Passenger sales are recognised as operating revenue when the transportation is provided. The value of unused tickets

is included as sales in advance of carriage on the statement of financial position and recognised as revenue at the

end of two years. This is estimated based on historical trends and experiences of the Group whereby ticket uplift

occurs mainly within the first two years. The carrying amount of the Group’s and the Company’s sales in advance

of carriage at 31 March 2012 was $1,456.8 million (2011: $1,459.8 million) and $1,409.5 million (2011: $1,421.1

million) respectively.