Singapore Airlines 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206

|

|

064 SINGAPORE AIRLINES

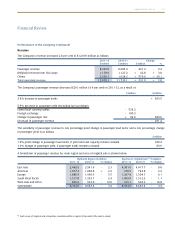

Financial Review

Performance of the Group

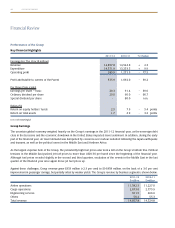

Key Financial Highlights

2011-12 2010-11 %Change

Earnings For The Year ($ million)

Revenue 14,857.8 14,524.8 + 2.3

Expenditure 14,571.9 13,253.5 + 9.9

Operating profit 285.9 1,271.3 - 77.5

Profit attributable to owners of the Parent 335.9 1,092.0 - 69.2

Per Share Data (cents)

Earnings per share – basic 28.3 91.4 - 69.0

Ordinary dividend per share 20.0 60.0 - 66.7

Special dividend per share - 80.0 n.m.

Ratios (%)

Return on equity holders’ funds 2.5 7.9 - 5.4 points

Return on total assets 1.7 4.9 - 3.2 points

n.m. not meaningful

Group Earnings

The uncertain global economy weighed heavily on the Group’s earnings in the 2011-12 financial year, as the sovereign debt

crisis in the Eurozone and the economic slowdown in the United States impacted travel sentiment. In addition, during the early

part of the financial year, air travel demand was dampened by concerns over nuclear radiation following the Japan earthquake

and tsunami, as well as the political unrest in the Middle East and Northern Africa.

As the largest expense item of the Group, the persistently high fuel prices also took a toll on the Group’s bottom line. Political

tensions in the Middle East pushed jet fuel prices to more than USD130 per barrel since the beginning of the financial year.

Although fuel prices receded slightly in the second and third quarters, escalation of the events in the Middle East in the last

quarter of the financial year once again drove jet fuel prices up.

Against these challenges, Group revenue grew $333 million (+2.3 per cent) to $14,858 million, on the back of a 3.6 per cent

improvement in passenger carriage, but partially offset by weaker yields. The Group’s revenue by business segment is shown below:

2011-12 2010-11

$ million $ million

Airline operations 11,582.3 11,227.0

Cargo operations 2,673.6 2,775.9

Engineering services 551.5 466.6

Others 50.4 55.3

Total revenue 14,857.8 14,524.8