Singapore Airlines 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 SINGAPORE AIRLINES

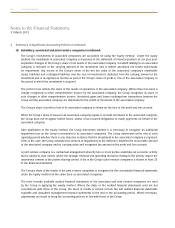

Notes to the Financial Statements

31 March 2012

2 Summary of Significant Accounting Policies (continued)

(b) New and revised standards (continued)

FRS 111 Joint Arrangements and Revised FRS 28 Investments in Associates and Joint Ventures (continued)

FRS 111 classifies joint arrangements either as joint operations or joint ventures. Joint operation is a joint arrangement

whereby the parties that have joint control of the arrangement have rights to the assets and obligations for the

liabilities relating to the arrangement whereas joint venture is a joint arrangement whereby the parties that have joint

control of the arrangement have rights to the net assets of the arrangement. FRS 111 requires the determination of

joint arrangement’s classification to be based on the parties’ rights and obligations under the arrangement, with the

existence of a separate legal vehicle no longer being the key factor. FRS 111 disallows proportionate consolidation

and requires joint ventures to be accounted for using the equity method. The revised FRS 28 was amended to

describe the application of equity method to investments in joint ventures in addition to associates. The adoption of

FRS 111 and the revised FRS 28 will not affect the Group as the Group does not apply proportionate consolidation

for its joint ventures.

FRS 112 Disclosure of Interests in Other Entities

FRS 112 is effective for financial periods beginning on or after 1 January 2013.

FRS 112 is a new and comprehensive standard on disclosure requirements for all forms of interests in other entities,

including joint arrangements, associates, special purpose vehicles and other off balance sheet vehicles. FRS 112

requires an entity to disclose information that helps users of its financial statements to evaluate the nature and risks

associated with its interests in other entities and the effects of those interests on its financial statements. As this is

a disclosure standard, it will have no impact to the financial position and financial performance of the Group when

implemented in 2013.

(c) Basis of consolidation

The consolidated financial statements comprise the separate financial statements of the Company and its subsidiary

companies as at the end of the reporting period. The financial statements of the subsidiary companies used in the

preparation of the consolidated financial statements are prepared for the same reporting date as the Company.

Consistent accounting policies are applied to like transactions and events in similar circumstances. A list of the

Group’s subsidiary companies is shown in Note 23 to the financial statements.

All intra-group balances, transactions, income and expenses and unrealised profits and losses resulting from intra-

group transactions are eliminated in full.

Business combinations are accounted for by applying the acquisition method. Identifiable assets acquired and

liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the

acquisition date. Acquisition-related costs are recognised as expenses in the periods in which the costs are incurred

and the services are received.

When the Group acquires a business, it assesses the financial assets and liabilities assumed for appropriate classification

and designation in accordance with the contractual terms, economic circumstances and pertinent conditions as at the

acquisition date. This includes the separation of embedded derivatives in host contracts by the acquiree.