Singapore Airlines 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175ANNUAL REPORT 2011/2012

Notes to the Financial Statements

31 March 2012

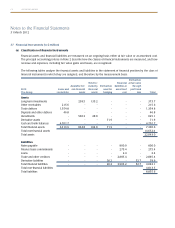

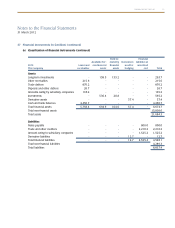

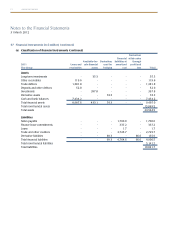

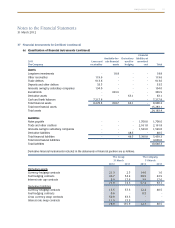

37 FinancialInstruments(in$million)(continued)

(b) Fair values (continued)

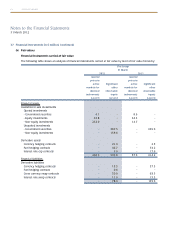

Financial instruments carried at fair value (continued)

Fair value hierarchy

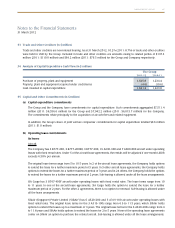

The Group classifies fair value measurement using a fair value hierarchy that reflects the significance of the inputs

used in making the measurements. The fair value hierarchy has the following levels:

• Level1–Quotedprices(unadjusted)inactivemarketsforidenticalassetsorliabilities

• Level2–InputsotherthanquotedpricesincludedwithinLevel1thatareobservablefortheassetorliability,

either directly (i.e., as prices) or indirectly (i.e., derived from prices)

Determination of fair value

The Group and the Company have carried all investment securities that are classified as available-for-sale financial

assets and all derivative instruments at their fair values.

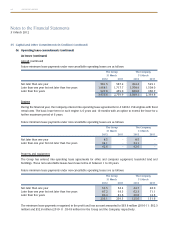

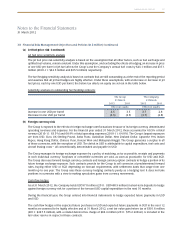

The fair values of jet fuel swap contracts are the mark-to-market values of these contracts. The fair values of jet fuel

option contracts are determined by reference to available market information and the Black-Scholes option valuation

model. As the Group hedges its jet fuel requirements in Mean of Platts Singapore Jet Kerosene (“MOPS”) and that the

majority of the Group’s fuel uplifts are in MOPS, the MOPS price (2012: USD 135.42/BBL, 2011: USD 133.22/BBL)

is used as the input for market fuel price to the Black-Scholes option valuation model. Consequently, the annualised

volatility (2011-12: 11.34%, 2010-11: 26.85%) of the jet fuel swap and option contracts is also estimated with daily

MOPS price. The continuously compounded risk-free rate estimated as average of the past 12 months Singapore

Government Securities benchmark issues’ one-year yield (2011-12: 0.33%, 2010-11: 0.38%) was also applied to

each individual jet fuel option contract to derive their estimated fair values as at the end of the reporting period.

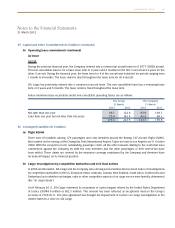

The fair value of forward currency contracts is determined by reference to current forward prices for contracts with

similar maturity profiles. The fair values of foreign currency option contracts, interest rate swap contracts and interest

rate cap contracts are determined by reference to valuation reports provided by counterparties.

The fair value of cross currency swap contracts is determined based on quoted market prices or dealer quotes for

similar instruments used.

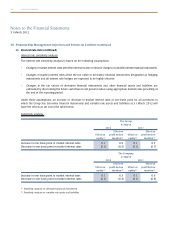

The fair value of quoted investments is generally determined by reference to stock exchange quoted market bid

prices at the close of the business at the end of the reporting period. For investments where there is no active

market, fair value is determined using valuation techniques. Such techniques include using recent arm’s length

market transactions or reference to the current market value of another instrument (which is substantially the same).

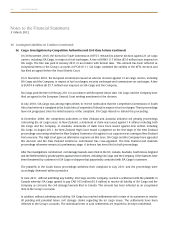

Financial instruments whose carrying amounts approximate fair value

The carrying amounts of the following financial assets and liabilities approximate their fair values due to their short-

term nature: cash and bank balances, funds from subsidiary companies, amounts owing to/by subsidiary companies,

trade debtors, other debtors, trade and other creditors.