Singapore Airlines 2012 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157ANNUAL REPORT 2011/2012

Notes to the Financial Statements

31 March 2012

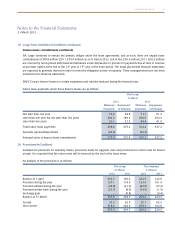

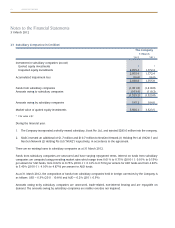

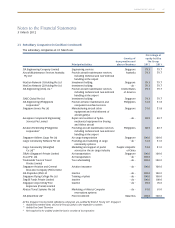

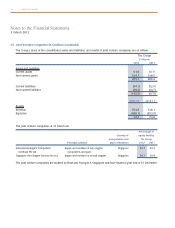

24 Associated Companies (in $ million) (continued)

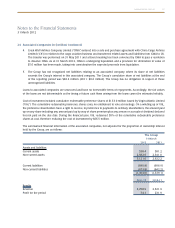

4. Great Wall Airlines Company Limited (“GWA”) entered into a sale and purchase agreement with China Cargo Airlines

Limited (“CK”) in relation to the cargo aviation business and transferred related assets and liabilities from GWA to CK.

The transfer was performed on 31 May 2011 and a Board meeting has been convened by GWA to pass a resolution

to dissolve GWA. As at 31 March 2012, GWA is undergoing liquidation and a provision for diminution in value of

$5.6 million has been made, taking into consideration the expected proceeds from liquidation.

5. The Group has not recognised net liabilities relating to an associated company where its share of net liabilities

exceeds the Group’s interest in this associated company. The Group’s cumulative share of net liabilities at the end

of the reporting period was $96.4 million (2011: $0.6 million). The Group has no obligation in respect of these

unrecognised liabilities.

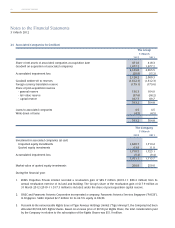

Loans to associated companies are unsecured and have no foreseeable terms of repayments. Accordingly, the fair values

of the loans are not determinable as the timing of future cash flows arising from the loans cannot be estimated reliably.

Cost of investment included cumulative redeemable preference shares of $133.0 million issued by Virgin Atlantic Limited

(“VAL”). The cumulative redeemable preference shares carry no entitlement to vote at meetings. On a winding up of VAL,

the preference shareholders have a right to receive, in preference to payments to ordinary shareholders, the amount paid

up on any share including any amount paid up by way of share premium plus any arrears or accruals of dividend declared

but not paid on the due date. During the financial year, VAL redeemed 50% of the cumulative redeemable preference

shares at cost, therefore reducing the cost of investment by $66.5 million.

The summarised financial information of the associated companies, not adjusted for the proportion of ownership interest

held by the Group, are as follows:

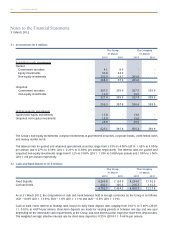

The Group

31 March

2012 2011

Assets and liabilities

Current assets 538.4 581.2

Non-current assets 2,582.6 2,341.0

3,121.0 2,922.2

Current liabilities (690.8) (696.9)

Non-current liabilities (673.8) (642.2)

(1,364.6) (1,339.1)

2011-12 2010-11

Results

Revenue 2,708.9 2,521.9

Profit for the period 74.1 231.9