Singapore Airlines 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117ANNUAL REPORT 2011/2012

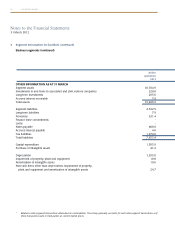

Notes to the Financial Statements

31 March 2012

2 Summary of Significant Accounting Policies (continued)

(z) Revenue (continued)

Revenue from repair and maintenance of aircraft, engine and component overhaul is recognised based on the

percentage of completion of the projects. The percentage of completion of the projects is determined based on the

number of man-hours incurred to date against the estimated man-hours needed to complete the projects.

Rental income from lease of aircraft is recognised on a straight-line basis over the lease term.

(aa) Income from investments

Dividend income from investments is recognised when the Group’s right to receive the payment is established.

Interest income from investments and fixed deposits is recognised using the effective interest method.

(ab) Employee benefits

(i) Equity compensation plans

Employees of the Group receive remuneration in the form of share options and share awards as consideration

for services rendered.

The Group has in place, the Singapore Airlines Limited Employee Share Option Plan and the SIA Engineering

Company Limited Employee Share Option Plan for granting of share options to senior executives and all other

employees. The exercise price approximates the market value of the shares at the date of grant.

The Group has also implemented the Singapore Airlines Limited Restricted Share Plan and Performance Share

Plan and the SIA Engineering Company Limited Restricted Share Plan and Performance Share Plan for awarding

of fully paid ordinary shares to senior executives and key senior management, when and after pre-determined

performance or service conditions are accomplished.

Details of the plans are disclosed in Note 5 to the financial statements.

The cost of these equity-settled transactions with employees is measured by reference to the fair value of the

options or awards at the date on which the share options or awards are granted. In valuing the share options and

share awards, no account is taken of any performance conditions, other than conditions linked to the price of the

shares of the Company and non-vesting conditions.

This cost is recognised in the profit and loss account as share-based compensation expense, with a corresponding

increase in the share-based compensation reserve, over the vesting period in which the service conditions are

fulfilled, ending on the date on which the relevant employees become fully entitled to the award (“the vesting

date”). Non-market vesting conditions are included in the estimation of the number of shares under options that

are expected to become exercisable on the vesting date. At the end of each reporting period, the Group revises

its estimates of the number of shares under options that are expected to become exercisable on the vesting date

and recognises the impact of the revision of the estimates in the profit and loss account, with a corresponding

adjustment to the share-based compensation reserve over the remaining vesting period.