Singapore Airlines 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121ANNUAL REPORT 2011/2012

Notes to the Financial Statements

31 March 2012

3 Significant Accounting Estimates (continued)

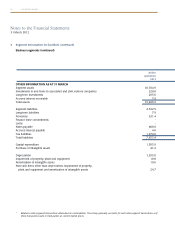

(d) Frequent Flyer programme

The Company operates a frequent flyer programme called “KrisFlyer” that provides travel awards to programme

members based on accumulated mileage. A portion of passenger revenue attributable to the award of frequent flyer

benefits is deferred until they are utilised. The deferment of the revenue is estimated based on historical trends of

breakage and redemption, which is then used to project the expected utilisation of these benefits. Any remaining

unutilised benefits are recognised as revenue upon expiry. The carrying amount of the Group’s and the Company’s

deferred revenue at 31 March 2012 was $497.0 million (2011: $445.1 million).

(e) Aircraftmaintenanceandoverhaulexpenditureunderpower-by-houragreements

The Group has entered into several power-by-hour (“PBH”) engine maintenance agreements with engine original

equipment manufacturers. The monthly payments are based on the number of flying hours flown. A portion of the

cost is expensed at a fixed rate per hour during the term of the PBH agreement. The remaining payments made are

recorded as an advance payment, to the extent that it is to be utilised through future maintenance activities, if any,

or capitalised upon completion of an overhaul.

The proportion of the amount to be expensed off and capitalised is determined based on the best estimate as if the

engine maintenance and overhaul costs are accounted for under the time and material basis. The carrying amount

of the advance payment relating to PBH agreements for the Group and the Company at 31 March 2012 was $684.3

million (2011: $538.1 million) and $634.3 million (2011: $497.5 million) respectively. The maintenance and repair

costs covered by PBH agreements which are expensed off during the year amounted to $38.0 million (2011: $40.2

milion) for the Group and $35.8 million (2011: $38.1 milion) for the Company.

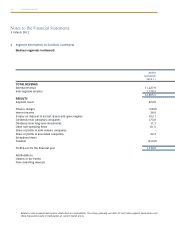

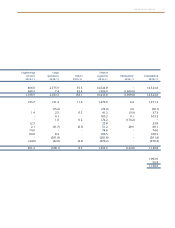

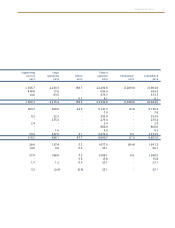

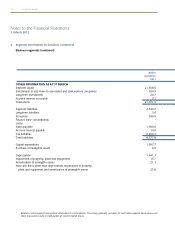

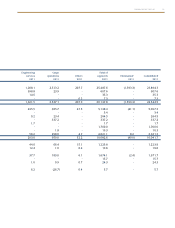

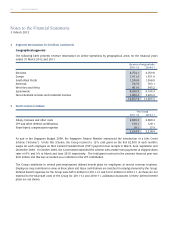

4 Segment Information (in $ million)

For management purposes, the Group is organised into business units based on the nature of the services provided,

and has 4 reportable operating segments as follows:

(i) The airline operations segment provides passenger air transportation.

(ii) The engineering services segment is in the business of providing airframe maintenance and overhaul services, line

maintenance, technical ground handling services and fleet management programme. It also manufactures aircraft

cabin equipment, refurbishes aircraft galleys, provides technical and non-technical handling services and repair and

overhaul of hydro-mechanical aircraft equipment.

(iii) The cargo operations segment is involved in air cargo transportation and related activities.

(iv) Other services provided by the Group, such as training of pilots, air charters and tour wholesaling, has been aggregated

under the segment “Others”.

Except as indicated above, no operating segments have been aggregated to form the above reportable operating segments.

Management monitors the operating results of its business units separately for the purpose of making decisions about

resource allocation and performance assessment. Segment performance is evaluated based on operating profit or loss

which in certain respects, as explained in the table below, is measured differently from operating profit or loss in the

consolidated financial statements.

Transfer prices between operating segments are on an arm’s length basis in a manner similar to transactions with

third parties.