Singapore Airlines 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139ANNUAL REPORT 2011/2012

Notes to the Financial Statements

31 March 2012

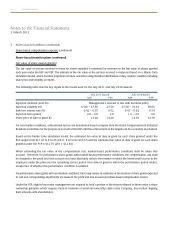

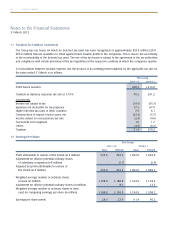

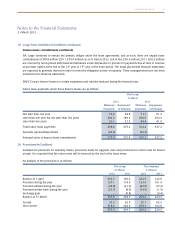

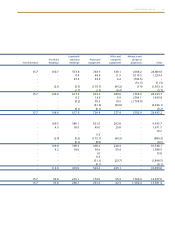

10 Exceptional Items (in $ million)

During the financial year, the Company and Singapore Airlines Cargo Pte Ltd (“SIA Cargo”) accepted a settlement offer from

the plaintiffs in the Canadian air cargo class actions to resolve all such actions on an agreed basis for an amount of CAD1.04

million ($1.3 million). The settlement is without admission of any wrongdoing or liability and is subject to court approval.

A provision has also been made for the payment by the Company of an administrative penalty pursuant to a settlement

agreement entered into with the South African Competition Commission. As part of the settlement, the Company has

agreed to pay an administrative penalty of ZAR25 million ($4.1 million) within 30 days of the settlement being confirmed

by an order of the South African Competition Tribunal. The issuance of a confirmation order by the Competition Tribunal

will bring a close to the Competition Commission’s investigation of the Company.

During the previous financial year, the exceptional items comprised fines paid by SIA Cargo as imposed by the European

Commission (EUR74.8 million or $135.7 million), the South Korean Fair Trade Commission (KRW3.1 billion or $3.6

million) and the United States Department of Justice Antitrust Division (USD48.0 million or $62.5 million).

SIA Cargo has filed appeals against the decisions made by the European Commission and the South Korean Fair Trade

Commission. In the appeals, SIA Cargo contests any suggestion that it was involved in a global conspiracy to fix surcharges.

SIA Cargo accepted the plea offer made by the United States Department of Justice. The plea agreement brought the

Department of Justice’s air cargo investigations in the United States to a close for SIA Cargo.

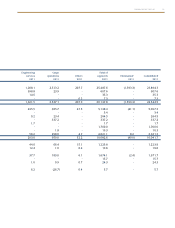

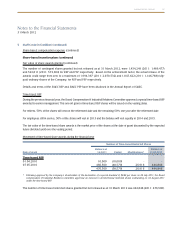

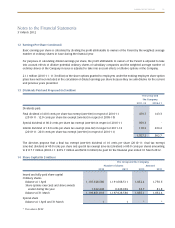

11 Taxation (in $ million)

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2012 and 2011 are:

The Group

2011-12 2010-11

Current taxation

Provision for the year 199.2 387.4

Overprovision in respect of prior years (0.1) (7.5)

Share of joint venture companies’ taxation 1.2 2.9

Share of associated companies’ taxation 13.7 12.6

214.0 395.4

Deferred taxation

Movement in temporary differences (139.5) (127.0)

(Over)/Underprovision in respect of prior years (23.1) 1.8

(162.6) (125.2)

51.4 270.2

Deferred taxation related to other comprehensive income:

The Group

2011-12 2010-11

Available-for-sale financial assets (0.4) (0.4)

Cash flow hedges 11.0 7.7

Share of comprehensive income of associated and joint venture companies 0.2 0.2

10.8 7.5