Singapore Airlines 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 SINGAPORE AIRLINES

Notes to the Financial Statements

31 March 2012

5 Staff Costs (in $ million) (continued)

Share-based compensation expense (continued)

Share-basedincentiveplans(continued)

Fair value of share awards granted

The fair value of services received in return for shares awarded is measured by reference to the fair value of shares granted

each year under the RSP and PSP. The estimate of the fair value of the services received is measured based on a Monte Carlo

simulation model, which involves projection of future outcomes using statistical distributions of key random variables including

share price and volatility of returns.

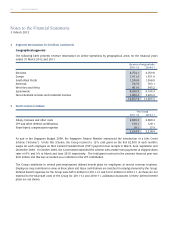

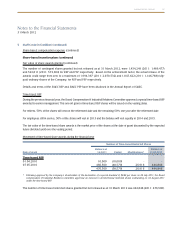

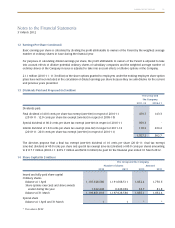

The following table lists the key inputs to the model used for the July 2011 and July 2010 awards:

July 2011 Award July 2010 Award

RSP PSP RSP PSP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 17.89 – 27.50 27.50 27.58 – 31.92 30.06

Risk-free interest rate (%) 0.42 – 0.75 0.52 0.47 – 0.62 0.54

Expected term (years) 2.0 – 4.0 3.0 1.9 – 3.9 3.0

Share price at date of grant ($) 14.20 14.20 14.70 14.70

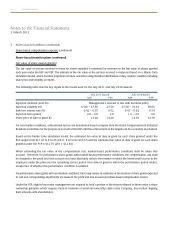

For non-market conditions, achievement factors are determined based on inputs from the Board Compensation & Industrial

Relations Committee for the purpose of accrual for the RSP until the achievement of the targets can be accurately ascertained.

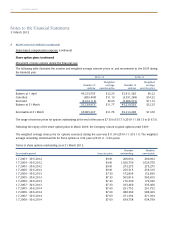

Based on the Monte Carlo simulation model, the estimated fair value at date of grant for each share granted under the

RSP ranges from $11.47 to $12.45 (2011: $12.93 to $13.77) and the estimated fair value at date of grant for each share

granted under the PSP is $12.75 (2011: $12.64).

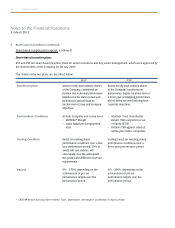

When estimating the fair value of the compensation cost, market-based performance conditions shall be taken into

account. Therefore, for performance share grants with market-based performance conditions, the compensation cost shall

be charged to the profit and loss account on a basis that fairly reflects the manner in which the benefits will accrue to the

employee under the plan over the remaining service period from date of grant to which the performance period relates,

irrespective of whether this performance condition is satisfied.

For performance share grants with non-market conditions, the Group revises its estimates of the number of share grants expected

to vest and corresponding adjustments are made to the profit and loss account and share-based compensation reserve.

Under the PSP, eligible key senior management are required to hold a portion of the shares released to them under a share

ownership guideline which requires them to maintain a beneficial ownership stake in the Company, thus further aligning

their interests with shareholders.