Singapore Airlines 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 SINGAPORE AIRLINES

Notes to the Financial Statements

31 March 2012

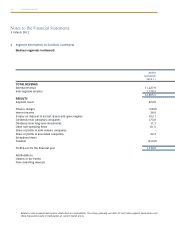

2 Summary of Significant Accounting Policies (continued)

(y) Taxation (continued)

(ii) Deferred tax (continued)

The carrying amount of deferred tax asset is reviewed at the end of each reporting period and reduced to the

extent that it is no longer probable that taxable profit will be available to allow all or part of the deferred tax

asset to be utilised. Unrecognised deferred tax assets are reassessed at the end of each reporting period and are

recognised to the extent that it has become probable that future taxable profit will allow the deferred tax asset

to be utilised.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the year when the

asset is realised or the liability is settled, based on tax rates and tax laws that have been enacted or substantively

enacted at the end of the reporting period.

Deferred income tax relating to items recognised outside profit or loss is recognised outside profit or loss.

Deferred tax items are recognised in correlation to the underlying transaction either in other comprehensive

income or directly in equity and deferred tax arising from a business combination is adjusted against goodwill

on acquisition.

Deferred income tax assets and deferred income tax liabilities are offset, if a legally enforceable right exists to

set off current tax assets against current income tax liabilities and the deferred income taxes relate to the same

taxable entity and the same tax authority.

(iii) Indirect Taxes

Revenues, expenses and assets are recognised net of the amount of indirect tax except:

• Wheretheindirecttaxincurredonapurchase ofassetsorservices isnotrecoverablefromthetaxation

authority, in which case the indirect tax is recognised as part of the cost of acquisition of the asset or as part

of the expense item as applicable; and

• Receivablesandpayablesthatarestatedwiththeamountofindirecttaxincluded.

The net amount of indirect tax recoverable from, or payable to, the tax authority is included as part of receivables

or payables in the statement of financial position.

(z) Revenue

Revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group and the

revenue can be reliably measured. Revenue is measured at the fair value of consideration received or receivable.

Revenue is principally earned from the carriage of passengers, cargo and mail, engineering services, training of pilots,

air charters and tour wholesaling and related activities. Revenue for the Group excludes dividends from subsidiary

companies and intra-group transactions.

Passenger and cargo sales are recognised as operating revenue when the transportation is provided. The value of

unused tickets and air waybills is included in current liabilities as sales in advance of carriage. The value of tickets

and air waybills is recognised as revenue if unused after two years and one year respectively.