Singapore Airlines 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115ANNUAL REPORT 2011/2012

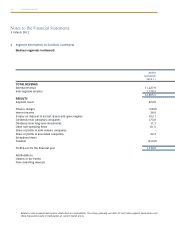

Notes to the Financial Statements

31 March 2012

2 Summary of Significant Accounting Policies (continued)

(x) Frequent flyer programme

The Company operates a frequent flyer programme called “KrisFlyer” that provides travel awards to programme

members based on accumulated mileage. A portion of passenger revenue attributable to the award of frequent

flyer benefits, estimated based on expected utilisation of these benefits, is deferred until they are utilised. These

are included under deferred revenue on the statement of financial position. Any remaining unutilised benefits are

recognised as revenue upon expiry.

(y) Taxation

(i) Current tax

Tax recoverable and tax liabilities for the current and prior periods are measured at the amount expected to

be recovered from or paid to the tax authorities. The tax rates and tax laws used to compute the amount are

those that are enacted or substantively enacted by the end of the reporting period, in the countries where the

Group operates and generates taxable income. Management periodically evaluates positions taken in the tax

returns with respect to situations in which applicable tax regulations are subject to interpretation and establishes

provisions where appropriate.

Current taxes are recognised in the profit and loss account except to the extent that the tax relates to items

recognised outside profit or loss, either in other comprehensive income or directly in equity.

(ii) Deferred tax

Deferred tax is provided, using the liability method, on all temporary differences at the end of the reporting

period between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes.

Deferred tax liabilities are recognised for all temporary differences, except:

• Where the deferred income tax liability arises from the initial recognition of goodwill or of an asset or

liability in a transaction that is not a business combination and, at the time of the transaction, affects neither

the accounting profit nor taxable profit or loss; and

• Inrespectoftaxabletemporarydifferencesassociatedwithinvestmentsinsubsidiary,associatedandjoint

venture companies, where the timing of the reversal of the temporary differences can be controlled and it is

probable that the temporary differences will not reverse in the foreseeable future.

Deferred income tax assets are recognised for all deductible temporary differences, carry forward of unused tax

credits and unused tax losses, to the extent that it is probable that taxable profit will be available against which

the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be

utilised except:

• Wherethedeferredincometaxassetrelatingtothedeductibletemporarydifferencearisesfromtheinitial

recognition of an asset or liability in a transaction that is not a business combination and, at the time of the

transaction, affects neither the accounting profit nor taxable profit or loss; and

• Inrespect ofdeductible temporarydifferences associatedwith investmentsin subsidiary,associatedand

joint venture companies, deferred income tax assets are recognised only to the extent that it is probable that

the temporary differences will reverse in the foreseeable future and taxable profit will be available against

which the temporary differences can be utilised.