Singapore Airlines 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Singapore Airlines Annual Report 05/06

3 Signifi cant Financial Impact of New and Revised Financial Reporting Standards (continued)

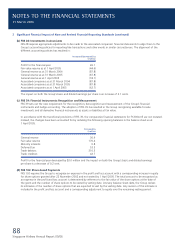

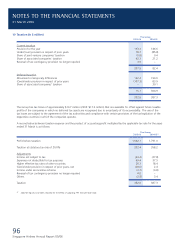

(d) FRS 102: Share-based Payments (continued)

The application of FRS 102 is retrospective and accordingly, the comparative fi nancial statements are restated and the

fi nancial impact on the Group is as follows:

Increased/(decreased) by

$ million

Profit for the financial year 2004-05 (38.4)

Profit for the financial year 2005-06 (48.1)

General reserve as at 31 March 2004 (11.5)

General reserve as at 31 March 2005 (48.4)

Share-based compensation reserve as at 31 March 2004 11.5

Share-based compensation reserve as at 31 March 2005 48.4

Decreased by

Cents

Basic and diluted earnings per share for 2004-05 (3.2)

Basic and diluted earnings per share for 2005-06 (3.9)

(e) FRS 103: Business Combinations; FRS 36: Impairment of Assets; FRS 38: Intangible Assets and

FRS 21: The Effects of Changes in Foreign Exchange Rates

The new accounting standard FRS 103: Business Combinations has resulted in consequential amendments to two other

accounting standards, FRS 36: Impairment of Assets and FRS 38: Intangible Assets.

Under FRS 103, goodwill acquired in a business combination is no longer subject to amortisation to the profi t and loss

account. Instead, it is subject to impairment review annually or whenever there is an indication that the goodwill is impaired

as required by the revised FRS 36. Any impairment loss is charged to the profi t and loss account and subsequent reversal is

not allowed.

The Group adopted FRS 103 with effect from 1 April 2005, including the provisions related to the limited retrospective

application of this standard. Accordingly, the general reserve as at 31 March 2005 has been restated to refl ect a decrease of

$0.3 million.

Previously, goodwill was amortised using the straight-line method over a period of between 10 and 20 years. No goodwill

amortisation was recorded for the fi nancial year 2005-06 (2004-05: $6.8 million). The intangible amortisation recorded

during the fi nancial year was $7.7 million (2004-05: nil).

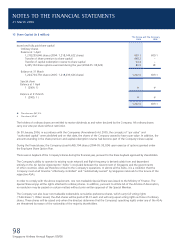

The Group changed its accounting policy to adopt FRS 21 with effect from 1 April 2005. As a result of the adoption of

revised FRS 21, any goodwill arising on the acquisition of foreign subsidiary and any fair value adjustments to the carrying

amounts of assets and liabilities arising on the acquisition are now treated as assets and liabilities of the foreign operation

and translated at the closing rate accordingly. The application of FRS 21 is retrospective.

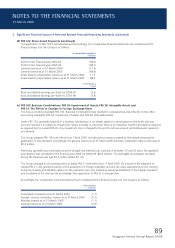

Accordingly, the comparative fi nancial statements are restated and the fi nancial impact on the Group is as follows:

Decreased by

$ million

Associated companies as at 31 March 2005 (7.1)

Foreign currency translation reserve as at 31 March 2005 (5.7)

Minority interest as at 31 March 2005 (1.1)

General reserve as at 31 March 2005 (0.3)

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006