Singapore Airlines 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

Singapore Airlines Annual Report 05/06

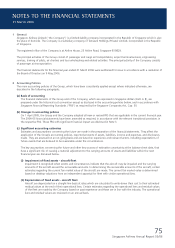

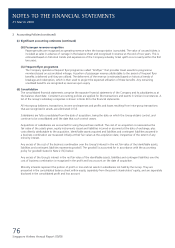

2 Accounting Policies (continued)

(m)

Derecognition of fi nancial assets and liabilities (continued)

Financial liabilities

A fi nancial liability is derecognised when the obligation under the liability is discharged or cancelled or expires.

Where an existing fi nancial liability is replaced by another from the same lender on substantially different terms, or the

terms of an existing liability are substantially modifi ed, such an exchange or modifi cation is treated as a derecognition of the

original liability and the recognition of a new liability, and the difference in the respective carrying amounts is recognised in

the profi t and loss account.

(n) Trade debtors

Trade debtors, including amounts owing by subsidiary, associated and joint venture companies, are classifi ed and accounted

for as loans and receivables under FRS 39. The accounting policy for this category of fi nancial assets is stated in Note 2(l).

Further details on the accounting policy for impairment of fi nancial assets are stated in Note 2(aa) below.

(o) Cash and bank balances

Cash and bank balances are defi ned as cash on hand, demand deposits and short-term, highly liquid investments readily

convertible to known amounts of cash and subject to insignifi cant risk of changes in value.

Cash on hand, demand deposits and short-term deposits are classifi ed and accounted for as loans and receivables under

FRS 39.

For the purposes of the Consolidated Cash Flow Statements, cash and cash equivalents consist of cash on hand and deposits

in banks, net of outstanding bank overdrafts. The accounting policy for this category of fi nancial assets is stated in Note 2(l).

(p) Deferred taxation

Deferred tax is provided, using the liability method, on all temporary differences at the balance sheet date between the tax

bases of assets and liabilities and their carrying amounts for fi nancial reporting purposes.

Additionally the Group’s deferred tax liabilities include all taxable temporary differences associated with investments in

subsidiary, associated and joint venture companies, except where the timing of the reversal of the temporary differences can

be controlled and it is probable that the temporary differences will not reverse in the foreseeable future.

Deferred tax assets are recognised for all deductible temporary differences and, carry forward of unused tax assets and

losses, to the extent that it is probable that taxable profi t will be available against which the deductible temporary differences

and, carry forward of unused tax assets and losses, can be utilised.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is no

longer probable that suffi cient taxable profi ts will be available to allow all or part of the deferred tax assets to be utilised.

Unrecognised deferred income tax assets are reassessed at each balance sheet date and are recognised to the extent that it

has become probable that future taxable profi t will allow the deferred tax asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is

realised or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the

balance sheet date.

Deferred tax is charged or credited directly to equity if the tax relates to items that are credited or charged in the same or a

different period, directly to equity.

(q) Loans, notes payable and borrowings

Loans, notes payable and other borrowings are initially recognised at the fair value of the consideration received less directly

attributable transaction costs. After initial recognition, interest-bearing loans and borrowings are subsequently measured at

amortised cost using the effective interest method.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006