Singapore Airlines 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

Singapore Airlines Annual Report 05/06

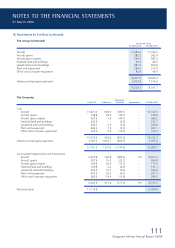

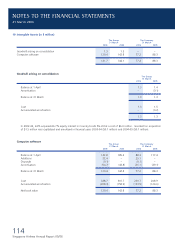

20 Subsidiary Companies (in $ million)

The Company

31 March

2006 2005

Investment in subsidiary companies (at cost)

Quoted equity investments ## ##

Unquoted equity investments 1,772.4 1,772.4

1,772.4 1,772.4

Impairment loss (16.6) (16.6)

1,755.8 1,755.8

Loans to subsidiary companies 182.6 180.0

1,938.4 1,935.8

Funds from subsidiary companies (1,220.9) (758.8)

Amounts owing to subsidiary companies (221.1) (207.8)

(1,442.0) (966.6)

Amounts owing by subsidiary companies 230.9 247.2

Market value of quoted equity investments 4,750.2 3,854.1

## The value is $2.

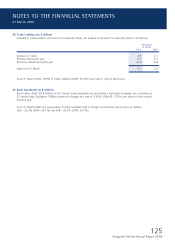

During the fi nancial year:

1. SIAEC and Parker Hannifi n Corporation’s Parker Aerospace Group incorporated a company, Aerospace Component

Engineering Services (“ACES”). SIAEC injected $7.2 million for its 51% equity interest in ACES.

2. SIAEC and Cebu Pacifi c Air incorporated Aviation Partnership (Philippines) Corporation (“APPC”). SIAEC injected $2.7 million

for its 51% equity interest in APPC.

3. Cargo Community Network (“CCN”) incorporated Cargo Community (Shanghai) Co Ltd (“CCS”). CCN injected $0.03 million

as part of its initial capital injection.

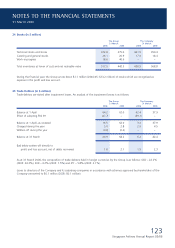

Loans to subsidiary companies are unsecured and have repayment terms of up to 10 years. Interest on loans to subsidiary

companies are computed using LIBOR, Singapore Interbank Bid Offer Rate (“SIBOR”) and SGD Swap-Offer Rates, and applying

agreed margins. The interest rates ranged from 0.81% to 4.84% (2004-05: 0.81% to 3.37%) per annum for SGD loans, and

1.56% to 5.05% (2004-05: 1.56% to 3.19%) per annum for USD loans.

Funds from subsidiary companies are unsecured and have varying repayment terms. Interest on funds from subsidiary companies

are computed using prevailing market rates which ranged from 1.06% to 3.31% (2004-05: 0.38% to 2.01%) per annum for

Singapore Dollar funds, from 2.63% to 4.72% (2004-05: 0.97% to 2.89%) per annum for US Dollar funds, from 5.41% to

5.51% (2004-05: nil) per annum for Australian Dollar funds, 1.98% per annum for Euro funds (2004-05: 2.10% to 2.11%) and

4.61% per annum for UK Sterling Pound funds (2004-05: 4.70% to 4.90%).

Amounts owing to/by subsidiary companies are unsecured, trade-related, interest-free and are repayable on demand.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006