Singapore Airlines 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Singapore Airlines Annual Report 05/06

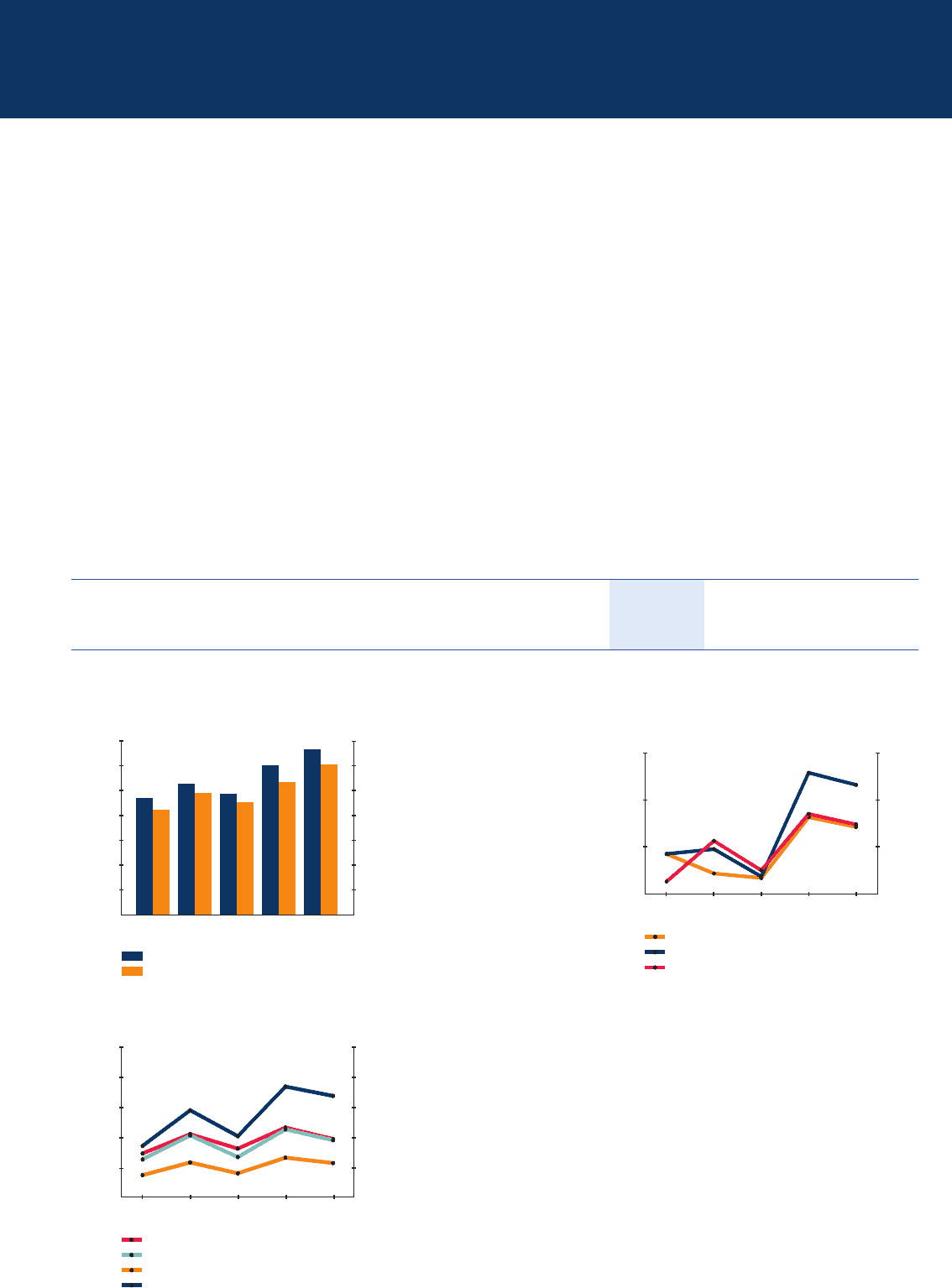

Group Revenue and Expenditure

$ Million

$ Million

2001-02 2002-03 2003-04 2004-05 2005-06

Revenue

Expenditure

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

Group Operating Profit, Profit Before Taxation and

Profit Attributable to Equity Holders of the Company

$ Million

$ Million

2001-02 2002-03 2003-04 2004-05 2005-06

Operating Profit

Profit Before Taxation

Profit Attributable to Equity Holders of the Company

2,000

1,500

1,000

500

2,000

1,500

1,000

500

Cents

Per cent

2001-02 2002-03 2003-04 2004-05 2005-06

Return on Turnover (%)

Return on Average Equity Holders’ Funds (%)

Return on Average Total Assets (%)

Basic Earnings Per Share (¢)

25

20

15

10

5

0

0

30

60

90

120

150

Group Profitability Ratios

FINANCIAL REVIEW

Performance of the Group

Group Earnings

The Group achieved an operating profi t of $1,213 million for the fi nancial year ended 31 March 2006. In comparison with

2004-05, the operating profi t dipped by $104 million (-7.9 per cent) from $1,317 million predominantly due to higher jet

fuel prices. Despite the runaway fuel prices, the Group was also able to curb the rise in expenditure through collective efforts

towards improved cost management, effi ciency and productivity. Excluding fuel, Group expenditure was actually lower by

1.4 per cent.

On the revenue front, passenger and cargo demand was robust, producing record revenue for the Group of $13,341 million

for the fi nancial year, which was $1,328 million (+11.1 per cent) higher than in 2004-05. The strong demand in 2005-06 was

underpinned by the growth in carriage and yields for passenger and cargo operations. Passenger yield improved 5.0 per cent

while cargo yield was up 7.5 per cent year-on-year.

Profi t attributable to equity holders of the Company dipped by $112 million (-8.3 per cent) to $1,241 million. A lower operating

profi t plus lower contributions from the sale of aircraft, spares and spare engines and the absence of exceptional items (2004-

05 profi t was boosted by the surplus on sale of investments in Air New Zealand, Raffl es Holdings and Taikoo) resulted in lower

earnings.

The Group’s earnings per share (basic) decreased 9.3 cents to 101.7 cents.

Profitability ratios of the Group are as follows:

2005-06 2004-05

R1 Change

% % % points

Return on turnover 9.8 11.7 – 1.9

Return on average total assets 5.8 6.7 – 0.9

Return on average equity holders’ funds 9.6 11.4 – 1.8

R1 Financial results for 2004-05 have been restated to account for share options to employees in compliance with Financial Reporting Standards (FRS) 102.

Previously, share options to employees were not charged to the profit and loss account.