Singapore Airlines 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Singapore Airlines Annual Report 05/06

Performance of the Group (continued)

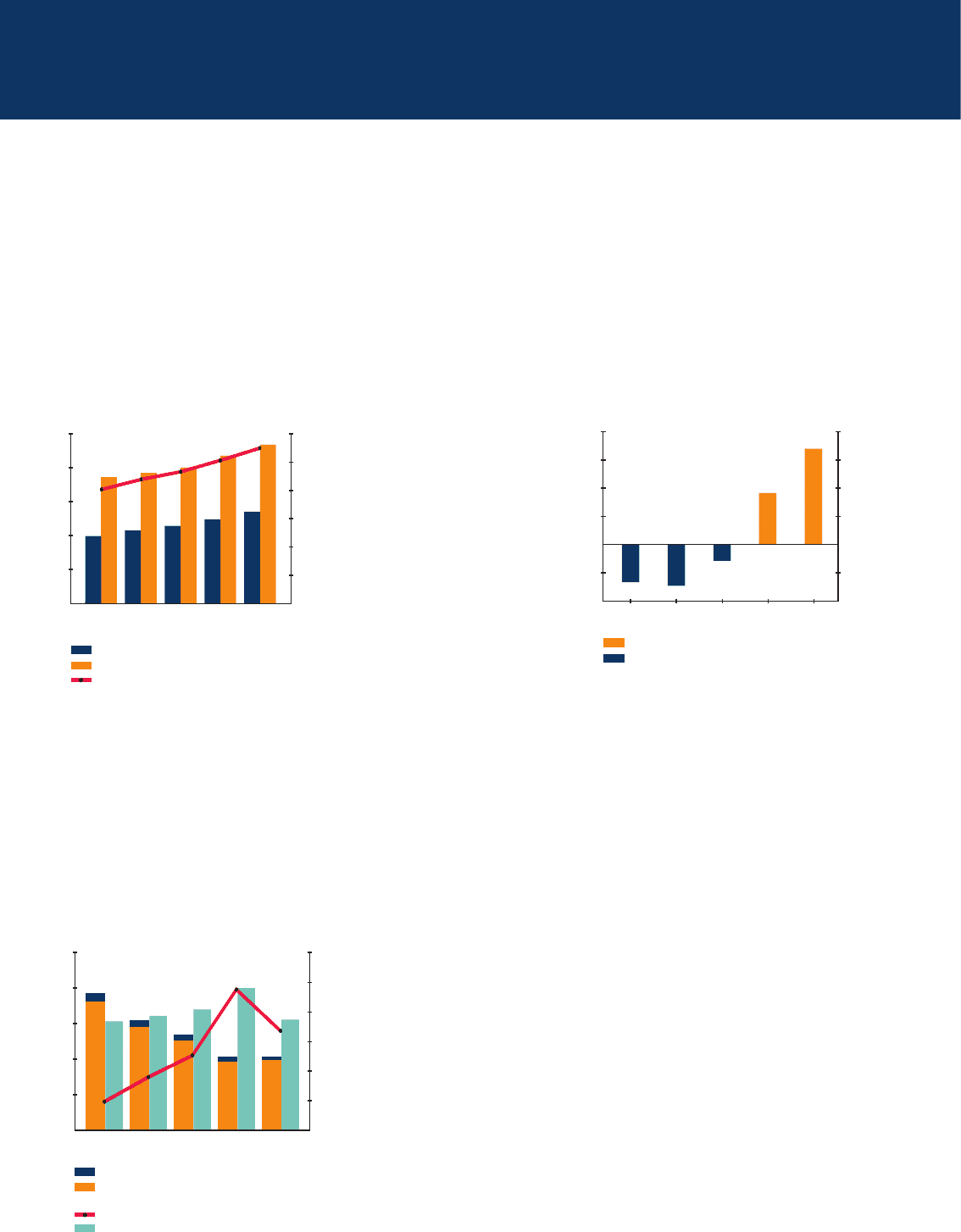

Financial Position of the Group

The Group’s total assets stood at $23,370 million as at 31 March 2006, up 7.5 per cent from a year ago. Net asset value

per share improved 8.6 per cent to $11.00.

Equity holders’ funds increased 9.1 per cent to $13,471 million as at 31 March 2006.

The Group improved its net liquid asset R1 position from $923 million a year ago to $1,706 million as at 31 March 2006.

This stronger cash position (+$783 million) was brought about largely by increased cash and bank balances in the Group

(+$311 million) and increased funds held with external managers (+$367 million). Total debt to equity ratio improved 0.02 times

to 0.17 times.

R1 Net liquid asset is defined as the sum of cash and bank balances (net of bank overdrafts), investments, loans to third parties, and net of finance lease

commitments, loans and fixed rate notes issued.

Capital Expenditure and Cash Flow of the Group

Capital expenditure was $2,059 million, 0.4 per cent lower than the year before. Internally generated cash fl ow of

$3,101 million was 1.51 times capital expenditure. About 96 per cent of the capital spending was on aircraft, together with

spare engines and components. In addition, progress payments were made for aircraft scheduled for delivery between 2006

and 2009.

2.3

2.0

1.7

1.4

1.1

0.8

0.5

Ratio

$ Million

Other Capital Expenditure ($ Million)

Capital Expenditure on Aircraft,

Engines and Spares ($ Million)

Cash Flow: Capital Expenditure Ratio

Internally Generated Cash Flow ($ Million)

5,000

4,000

3,000

2,000

1,000

0

2001-02 2002-03 2003-04 2004-05 2005-06

Group Capital Expenditure

Internally Generated Cash Flow

FINANCIAL REVIEW

12

10

8

6

4

2

0

Group Equity Holders’ Funds, Total Assets

and Net Asset Value (NAV) Per Share

Dollars

$ Million

2002 2003 2004 2005 2006

31 March

Equity Holders’ Funds ($ Million)

Total Assets ($ Million)

NAV Per Share ($)

25,000

20,000

15,000

10,000

5,000

0

2,000

1,500

1,000

500

0

-500

-1,000

Group Net Liquid Assets and Net Debt

$ Million

$ Million

2002 2003 2004 2005 2006

31 March

Net Liquid Assets

Net Debt

2,000

1,500

1,000

500

0

-500

-1,000